AMD: New year, same worries

Bank of America analyst Sumit Dhanda is projecting anything but a happy New Year for AMD.

The analyst in a research note Wednesday, kicked off 2008 by downgrading AMD to "sell" and projected "more pain ahead." Dhanda's rating change comes amid a broader call on the semiconductor industry, but AMD took the brunt of the hit.

Here's Dhanda's argument:

It can get worse and Barcelona isn't a savior. Dhanda says that AMD is likely to lose more market share. The analyst writes:

Irrespective of whether AMD will be able to deliver on its promise to ramp the much-delayed Barcelona platform in volumes by 1Q08/2Q08, we believe Barcelona will do very little to stem the share losses AMD will likely witness in servers and desktops vs. Intel's more competitive line-up.

Add it up and AMD shares are expected to get whacked in 2008 even though the stock fell 62 percent in 2007.

AMD's costs are too high. Higher material costs and depreciation are likely to put the kibosh on profitability, says Dhanda. On the parts front, Dhanda notes that quad-core components are more expensive. This point is notable since it implies that quad-core chips from AMD won't command enough of a premium to offset an increase in component inflation.

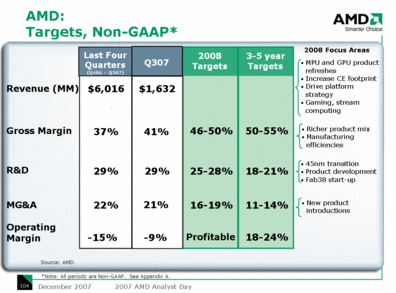

AMD's current profit target is too optimistic for 2008. Dhanda expects a motherboard correction and a weaker than expected first half outlook.

Also see:

- AMD: Is the glass half full–or empty?

- AMD acknowledges quad-core woes; Promises rebound; Highlights roadmap

Here's AMD's outlook, which projects above industry growth rates.

That final point from Dhanda is in stark contrast with AMD's management tone at its analyst meeting. AMD's biggest issue in 2008 is that it could overpromise and underdeliver again. Instead of playing to the pessimistic crowd and then topping expectations AMD management says it doesn't understand how people can't be optimistic. That shtick never works with Wall Street. Here's the playbook: Take the hit, acknowledge you stink, lower expectations, keep your optimism to yourself and then surprise people.

Meanwhile, AMD may hit economic headwinds. Dhanda also downgraded his outlook for the semiconductor market in 2008. In a nutshell, Dhanda argues that the chip recovery in 2007 has "run its course," inventories "are slightly above equilibrium levels," global growth is in question and the first half is seasonally weak.

Dhanda also cut his chip sales growth forecast in 2008 to 7 percent from 11 percent. Demand issues are expected to appear first in the PC supply chain and then spread to the chip sector. He downgraded five chipmakers to neutral (including Analog Devices, Intel, Texas Instruments, Power Integrations and Semtech) and three to sell (AMD, LSI and National Semiconductor).