AMD's new dawn: 'Tickled pink' about GlobalFoundries deal; Challenges remain

AMD has closed the spin-off of its manufacturing assets, received a much needed cash injection, created product lineup that is competitive and set course for a more focused future. These moves, however, come amid a sharp decline in PC and server demand. Where is AMD headed?

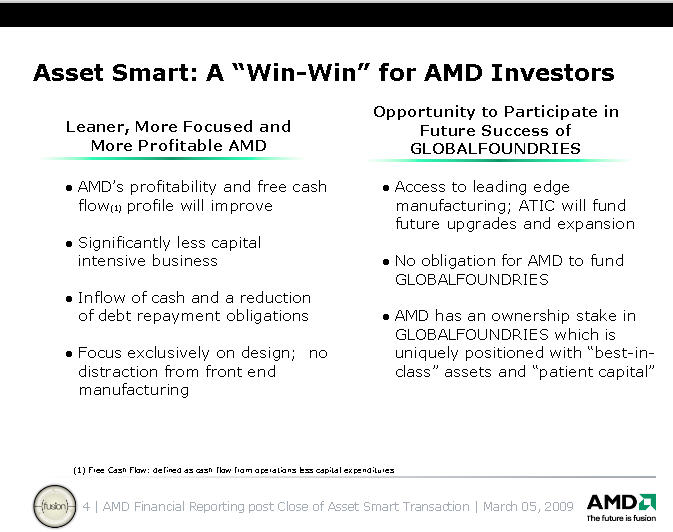

For now the only thing that really matters is that AMD is clearly off of life support. Last week, AMD closed its deal with Advanced Technology Investment Co. and Mubadala Development to create GlobalFoundries (AMD, GlobalFoundries statements). The closure of the deal had a little hiccup, but now the deal is done AMD has more focus, less debt and $825 million in new cash.

Bob Rivet, AMD's Chief Operations and Administrative Officer, said Thursday that the GlobalFoundries deal "is a truly transformation transaction for AMD." Rivet said that AMD's move will be key to its growth strategy and allows it to leverage 40 years of manufacturing experience without capitalizing it. "AMD is now leaner," said Rivet, who reiterated that the chip maker will be free cash flow positive in 2009. "We are tickled pink to get this [transaction] done."

Also see: AMD wins approval for manufacturing spin-off

AMD posts 9th straight loss; reveals Intel concerns about planned spin-off

AMD announces layoffs, salary cuts

Meanwhile, AMD has a new chairman and the Hector Ruiz era has officially ended. Bruce Caflin, former CEO of 3Com, takes over as chairman at AMD. Ruiz becomes chairman of the GlobalFoundries.

In many respects, AMD gets a do-over. AMD still owns 34.2 percent of the Foundry Co. so it's not like it is completely out of the manufacturing business. But AMD does rid itself of those capital intensive businesses that could have nuked the company. GlobalFoundries has a lot of potential and could help fabless companies like Broadcom and Xilinx, but will be saddled with weak demand and excess capacity in the chip industry for a while.

Here's why the GlobalFoundries move is big for AMD: The fabrication plant (fab) assets had a $1.1 billion debt burden that could have become an anchor around the company's neck.

As UBS analyst Uche Orji notes:

[The GlobalFoundries deal] provides AMD with much needed runway to achieve a path to profitability and to be able to pay down/refinance its $1.9 billion of Senior Notes due 2012.

Here's a look at AMD's new debt picture:

And.

FTN Equity Capital analyst Joanne Feeney adds:

We see much reduced liquidity risk under the new arrangement, better gross margins, and stronger incentives to excel on product design. We estimate that AMD has sufficient cash to weather even a prolonged downturn. The company has embarked on a more manageable (and lower-risk) product roadmap.

Going forward, the AMD story is really simple. AMD designs computing and graphics processors.

Is AMD back on the road to profitable success? AMD has clearly made it to the starting line. But there are significant elephants--most of them tattooed with Intel Inside logos--in the room. Here's a look at the risk AMD still has on deck--even though that deck is much cleaner than it used to be.

Elephant 1:

Intel's Nehalem platform. AMD executives note that Intel's Nehalem platform could be risky to customers since it requires a new architecture. Analysts, however, see a big threat. Orji adds:The competitive threat from Intel continues to grow as it has extended its technology lead at 45nm to about 1 year, which may further grow at 32nm. Intel’s Nehalem processor for 2-socket servers (late March launch) is expected to be competitive with AMD’s more costly 4-socket implementation, while Intel’s high volume 32nm mainstream desktop/notebook processors with graphics (1Q10 ramp) are likely to materially improve upon Intel’s current performance leading products.

Nehalem raises an interesting conundrum. Can AMD out-design Intel and get the manufacturing edge from GlobalFoundries? Intel has maintained that manufacturing is its competitive edge and it continues to push the envelope. Can AMD do the same?

Elephant 2:

There's an Intel lawsuit on the horizon. JMP Securities analyst Alex Gauna sums up the litigation risk nicely:On January 20, 2009,AMD received a letter from Intel requesting a meeting to discuss 1976 and 2001 Patent Cross License Agreements and the ability to transfer these agreements to the new foundry entity. AMD believes the foundry will qualify as a “Subsidiary” under the cross license terms. We believe Intel disagrees and will soon bring litigation to block or impede the transfer of IP to the AMD foundry. We are increasing OpEx assumptions beginning in 3Q09 to account for higher litigation costs.

Elephant 3:

Demand, demand, demand: Demand for servers and PCs is down and could remain in the dumps for a while. AMD's survival is now a given, but the big question is whether it can generate enough profits and cash in the downturn to meet its 2012 debt obligations.Orji estimates that won't see an operating or net profit for at least another two years. However, AMD's new earnings picture shows that the company is at least capable of hunkering down as the economy unravels.

Bottom line: AMD is in a much better competitive position than it was two weeks ago. However, Intel and a weak economy will continue to make life difficult for the chip maker.