Analyst: FTC could block Google-DoubleClick deal; Is there a case?

Scott Cleland, an analyst at the Precursor group, argues in a 36-page white paper that the Federal Trade Commission could shoot down Google's acquisition of DoubleClick.

First a few notes:

- I've interviewed Cleland a few times mostly on telecommunications matters and find him very credible. He knows tech, telecom and their intersection with Washington DC. Precursor primarily deals with telecom research and generally isn't shy about producing independent opinion.

- Regulatory scrutiny of Google falls in the "be careful what you wish for" category. Google has been screaming about Microsoft's desktop search. Perhaps Google has gotten so loud that regulators are saying, "Hey, what about Google?"

With that out of the way let's look at Cleland's argument, which not surprisingly has been panned almost in real-time.

Cleland conclusion: "The facts and evidence will prove that the Google-DoubleClick merger will substantially lessen competition in the appropriate defined-relevant market: targeted online advertising – warranting the FTC to file an injunction in Federal court to block the transaction. The facts and evidence will also prove this to be a standard horizontal merger to monopoly of

My take: This argument doesn't seem all that controversial to me. If the FTC defines the market as online advertising and not advertising overall Google and DoubleClick make a potentially scary team. Cleland's most valid point throughout the discussion is that the government doesn't understand the Google-DoubleClick deal.

On page 4 of the whitepaper Cleland notes that:

There are a variety of strong reasons why the Government has not yet fully connected-the-dots of Google’s breathtakingly fast accumulation of existing market power in targeted online

advertising, let alone understand the anti-competitive implications of Google’s rapid-fire acquisition strategy to extend its existing market power more broadly.

It's hard to argue with that either, especially given the fear of Google is rampant lately. While techies seem to smell Google's dominance growing it's doubtful that the government has any clue.

Here's where Cleland's argument runs into trouble: He expects that the FTC will get Google's plans and block it in a "watershed event for the business model of the Internet." Without a lot of lobbying and education I'm not confident the government will suddenly "get it." Meanwhile, if the FTC defines the market for Google-DoubleClick as the entire advertising market the deal has to be approved.

Cleland conclusion: The advent of the Internet created the fundamental dichotomy of offline and online advertising. All advertising involves communications and since the Internet has radically changed communications, the Internet has radically changed advertising.

My take: This is the linchpin for Cleland's entire argument. Look at the earnings of any newspaper company (Gannett, New York Times etc.) and the dichotomy becomes clear.

Cleland argues that online advertising is different because of architecture, interactivity, separate audiences and economics.

That's true, but the flip side of this argument is that you can draw ties between traditional advertising and the online variety. In many respects, online advertising resembles direct marketing. Google will argue that advertising is advertising.

In Cleland's discussion he notes something interesting: The FTC can use Google's own words against it. If the market is online advertising as a whole why does Google spend so much time talking about how online advertising is so much better? Indeed, if the FTC wants to define the market as online advertising there's plenty of Google public statements to make the case.

Cleland writes:

The dilemma that Google finds itself in will only get tougher if and when the FTC requires affidavits under oath on this market definition. Every Google representative asserting under oath that the online market is just part of the broader offline market of advertising, will have to consider if there is a record, recording, letter, memorandum, or public statement that

another Google representative may have made that could directly impeach their sworn testimony.

If you further define the market as targeted online advertising the situation looks even more bleak for Google. If Google is successful arguing that it and DoubleClick are a small piece of the overall advertising pie FTC approval is a lock. Defining the market for FTC's purposes is everything.

Cleland conclusion: "While Google claims to be in a highly competitive search market, by pointing to over a hundred

My take: For sure, Google is dominant. But switching costs are nil. You can live without Google. Cleland argues that startups are little threat largely due to Google's infrastructure and search algorithm. That's true. Then again no one saw Google coming either.

Cleland argues that Microsoft and Yahoo are "decreasingly competitive" with Google. Why? The network effect. The big question is whether the FTC will buy the argument that network effects are to be discouraged. It's also a little hard to believe that Microsoft and Yahoo will never compete with Google. Regarding Microsoft I remember this company called Netscape...

He also argues that DoubleClick is anti-competitive.

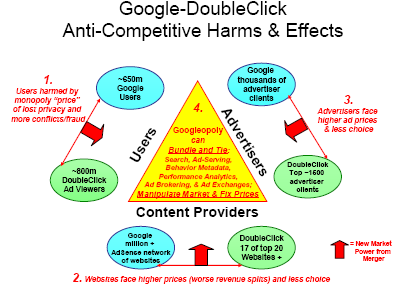

Cleland conclusion: The market power created by the Google-DoubleClick merger would lessen competition and

- Enabling Google-DoubleClick to effectively dominate:

- Online ad-serving to websites;

- The monetization model for accessing Internet content; and

- Providing Google-DoubleClick greater opportunity to collude to manipulate the targeted online advertising market, raise prices, fix prices, and price predatorily.

My take: The challenge here is showing harm. Many smaller players make money solely because of the Google economy.

Cleland argues that consumers would be harmed as Google and DoubleClick go ad happy. It could increase the real estate devoted to ads at the expense of content. That could happen. But again the consumer could just go elsewhere.

Cleland also argues that content providers would also be hurt by higher prices (see his chart below). The issue here is that there's Yahoo and Microsoft with their ad systems waiting to snare customers.

[poll id=72]