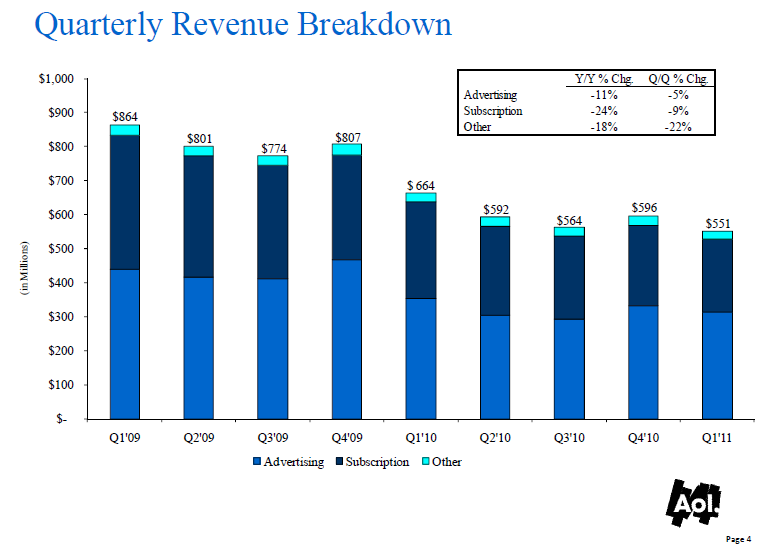

AOL: The revenue slide continues, but display ads show signs of life

AOL revenue continues to decline at a double-digit clip.

The company reported first quarter earnings of $4.7 million, or 4 cents a share, on revenue of $551.4 million, down 17 percent from a year ago. The results included restructuring costs and the Huffington Post purchase. AOL didn't provide earnings excluding those costs.

According to Thomson Reuters, analysts were expecting AOL to report a profit of 19 cents a share. Excluding restructuring costs, AOL earnings would have been 22 cents a share, according to Thomson Reuters. AOL's revenue was also better than Wall Street estimates of $526.3 million.

AOL CEO Tim Armstrong noted that global display ad revenue increased for the first time since 2007 with a gain of 4 percent from a year ago. U.S. display revenue was up 11 percent in the first quarter, or 6 percent excluding acquisitions. However, AOL's results leave a lot to be desired.

To wit:

- Ad revenue in the first quarter was down 11 percent to $313.7 million.

- Subscription revenue fell 24 percent in the first quarter to $215.4 million.

- Domestic average unique visitors to AOL were flat at 112 million.

- Domestic monthly unique visitors to AOL Huffington Post Media Group were down 3 percent from a year ago to 100 million.

- Net income was down 86 percent from a year ago.

On a conference call, Armstrong said:

Q1 is a milestone quarter for us as AOL and we made many meaningful changes to the company over the last two years and I think those changes are clearly paying off in the Q1 results. Q1 was an incredibly busy quarter for us with of all the quarters have been, but if you cut to the bottom line of the quarter, I think reducing our cost structure overall, the bureaucracy and really increasing operational speed in technological speed to be lighter, faster and starter I think that is clear in the Q1 results. And, I believe it is also the strategic leverage that is going to move as forward as a business. AOL is building a content company for the digital age. We have one vision, when strategy and when execution plan.

Armstrong said that future growth will come from display ads, content, Patch and local content as well as moderating subscription declines. The company also expects to step up its focus on mobile, but profits will be a 2012 story.