AOL: Will Armstrong get any honeymoon?

AOL will lay off a third of its workforce once it is spun off as a public company. The company's ad business is a wreck. And the best thing AOL has going for it is a subscription model (read dial-up) that's also in decline. Welcome back to the big leagues where there may be little to no honeymoon for AOL Chief Tim Armstrong.

When Armstrong took over at AOL I figured it was a good risk-adjusted career move. AOL was a mess. Armstrong could swoop in with his Google Web cred and either fix it or say there's only so much one guy can do.

We'll see how all that goes after a few earnings conference calls as a public company. Simply put, the odds may be stacked against Armstrong and AOL's success. Meanwhile, these questions about AOL will be raised quickly if shares swoon. How many Time Warner shareholders are really going to hold AOL shares after the Internet company is spun off? And will there be buyers of AOL shares on the other side of the transaction? Add it up and you have all the ingredients for a rocky road once AOL is spun off Dec. 9.

Let's check out recent events (Techmeme):

- AOL on Thursday said in an SEC filing that it will lay off a third of its workers to save roughly $300 million in costs. AOL is seeking voluntary departures first and then the involuntary kind if that fails. The cuts, 2,500 workers or so, is probably necessary, but morale won't be so hot for a while.

- The AOL assets an investor buys in 2009 won't be the same as he'll hold in 2010. To say AOL is a work in progress is an understatement. Kara Swisher reports that AOL is looking to unload MapQuest and ICQ. In addition, AOL wants to transition to being a content giant.

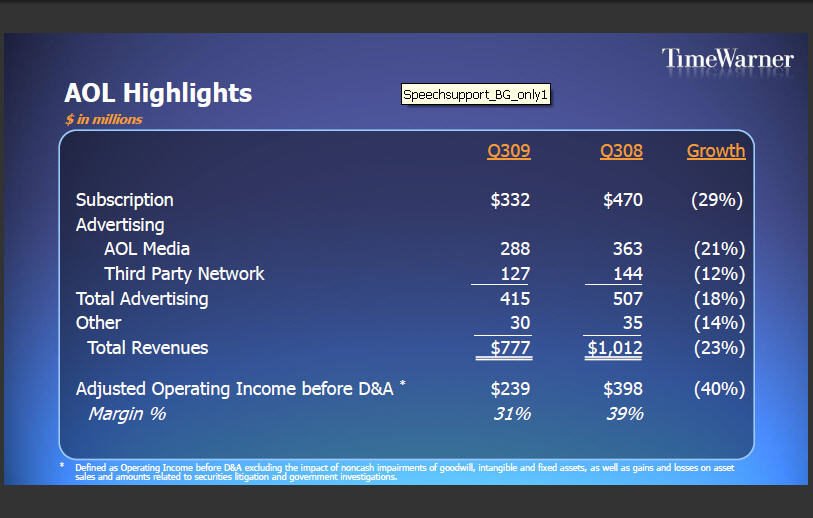

- And then there's AOL's financial picture. It's clear that AOL is a company still propped up by the dial-up access business. Sure, it's a fine business to milk, but it's also in decline. Armstrong should be thanking all of those consumers that still cling to dial-up access. If I were him I'd send them a ton of AOL swag. And he just might since he realizes how important dial-up is to funding AOL's future.

Henry Blodget put it well earlier this week. The gist of Blodget's take:

- The dial-up business provides nearly all of AOL's profit.

- The dial-up business generate 25 percent to 50 percent of traffic to AOL.

- The dialup business is shrinking 30 percent a year.

- The ad business is shrinking 20 percent a year.

Add it up and the plan to have a big profitable ad business to offset the dial-up unit just hasn't panned out. Will that change for Armstrong?

Given that perspective you'd be better off buying shares of EarthLink than AOL. After all, AOL is carried by the dial-up business. With EarthLink you at least get a decent dividend. Time Warner shareholders as of Nov. 27 get one share of AOL per 11 shares of Time Warner (fractional shares will be sold in the open market). Depending on how AOL trades, it could realistically make sense to ditch the AOL and buy the EarthLink---assuming you really want in on the not-so-hot dial-up business.

AOL's financial picture, divulged in Time Warner's third quarter earnings report, reveal more ugliness.

And 2010 isn't expected to get much better. Wells Fargo analyst John Janedis lowered his 2010 estimates for AOL on Monday. He wrote in a research note:

Based on more-conservative subscription revenue and search/monetization assumptions, we're lowering both our 2010 revenue and EBITDA estimates, resulting in decremental margin of about 72% versus 51% in 2009E. Our 2010 revenue and EBITDA assumptions are $2.688B (-16.4% yr/yr) and $712MM (-34.6% yr/yr), with subscription revenue down 25.8% and ad revenue down 9.8%.

The good news for Armstrong? He's starting from a low base. If AOL has any improvement going forward, Armstrong will look like a star. But he better get that ad business going or the honeymoon will be over faster than you execute a sell order on AOL shares.