AOL's first quarter: Turnaround delayed as ad sales weak

AOL CEO Tim Armstrong is going to need a few more quarters to turn the company around as first quarter earnings were a disappointment across the board.

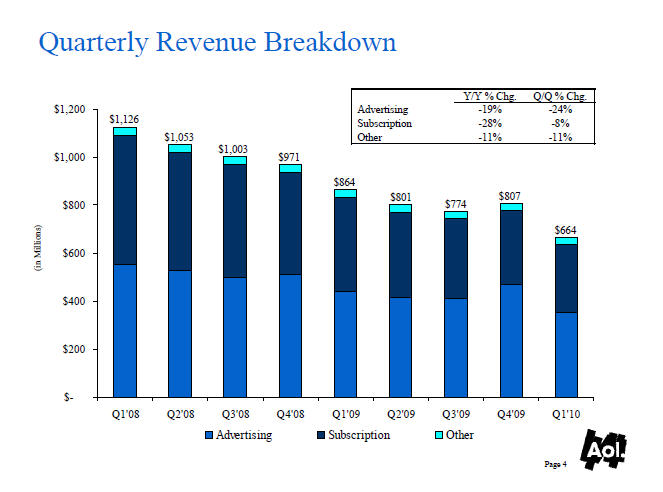

While other companies such as Yahoo noted a rebound in advertising revenue, AOL's ad sales fell 19 percent from a year ago. Armstrong noted that advertising results were hurt by restructuring.

The company reported first quarter net income of $34.7 million, or 32 cents a share, compared to earnings of $82.7 million, or 78 cents a share a year ago. Revenue for the quarter was $664.3 million, down 23 percent from a year ago (statement).

With AOL you expect subscription revenue to plunge each quarter---down 28 percent in the first quarter to $282.7 million---but the ad drop-off of 19 percent was notable.

Indeed, AOL said the first quarter revenue "reflects the disruption associated with our domestic salesforce reorganization, international restructuring initiatives and a lower volume of AOL Properties inventory monetized through our network."

Armstrong's task is to turn this revenue chart around:

That said, Armstrong said he was "encouraged by the advertising market's recent strength." AOL's restructuring will now hit phase two and the company will pursue its ad and content strategy.

It remains to be seen if the ad trends will improve.

As part of that strategy, AOL has been unloading non-strategic assets. The company said it sold its ICQ operations for $187.5 million, a sum lower than expectations (statement). AOL is also looking to sell or shut down Bebo.

Simply put, this AOL revival is going to take some time. Investors are questioning whether they should stick around.