Apple beats estimates; credits iPhone sales

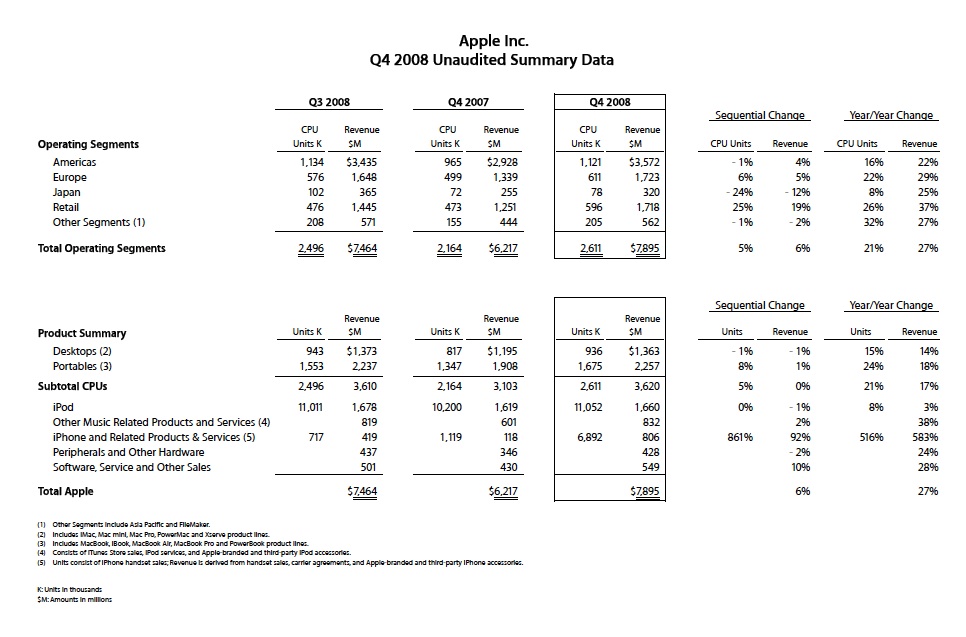

updated: Apple reported fiscal fourth quarter earnings of $1.14 billion, or $1.26 per share, on revenue of $7.9 billion, beating Wall Street estimates of $1.11 per share on $8.05 billion in revenue. (statement) The company credited the strong quarter partly on iPhone sales - "We sold more phones than RIM,” CEO Steve Jobs said in a statement, about Research in Motion, maker of the Blackberry.

Still, investors are looking ahead at the holiday season, asking if a new line of iPods and a refresh of the MacBook line can counter the global economic slump and uncertain consumer confidence. The company provided a wide range for its guidance, putting revenue at $9 billion to $10 billion and earnings per share to $1.06 to $1.35. In a statement, company CFO Peter Oppenheimer said, "Looking ahead, visibility is low and forecasting is challenging, and as a result we are going to be prudent in predicting the December quarter."

In the same quarter last year, Apple reported earnings of $904 million, or $1.01 per share, on revenue of $6.22 billion. Gross margins were 34.7 percent, up from 33.6 percent for the same quarter last year.

CEO Steve Jobs made a rare appearance on the conference call and addressed the folks on the call with his take on the success of the iPhone, growth of the App Store and his general thoughts on the downturn. "We are not economists," Jobs said, noting that the company also isn't sure of the impact of the bumpy economic conditions. "We read the same newspapers you do."

Other highlights from the quarter:

- The company sold 6.9 million iPhones, taking the company passed its goal of 10 million sold for 2008 - with two months left in the year. The company said iPhone is now 39 percent of the total business.

- Apple shipped 2.61 million Mac computers, a 21 percent increase over the year-ago quarter. It set a company record for a single quarter.

- More than 11 million iPods were sold, up eight percent from a year ago. The company said it was record for a non-holiday quarter. It's market share for portable music players remained above the 70 percent mark.

- The iTunes store has more than 65 million active accounts and a catalog of 8.5 million titles. It has just added more television shows, renewed its content deal with NBC and added high-def programming.

- The company has $25 billion in cash and zero debt. In a call with analysts, Jobs hinted that the financial position gives the company the "ability to invest our way through this downturn."

- The iPhone App store expects to see its 200 millionth application downloaded by tomorrow, 102 days since the July launch.

Shares of Apple were down 7 percent in regular trading, closing at $91.49. The stock mostly recovered in after-hours trading, jumping to more than 7 percent in active trading.