Apple earnings cheat sheet: It's all about the Mac units

Apple reports its fiscal second quarter results Wednesday and the most important item driving the quarter will be Mac sales.

All eyes will be on Mac units. Apple's Mac--despite a lot of focus on the iPhone--will make or break the quarter. Chances are pretty good that the Mac will make the quarter. Memory prices were weak during the March quarter and that should enable Apple to deliver strong earnings.

Apple (all resources) is expected to report second quarter earnings of $1.07 a share on sales of $6.96 billion. For the June quarter, Apple is expected to report earnings of $1.10 a share on sales of $7.16 billion.

Among the key items to monitor:

- Mac units: Piper Jaffray analyst Gene Munster reckons that Mac units could reach 2.1 million in the quarter. The consensus calls for 2 million units. NPD figures indicate 48 percent growth in Mac sales, but usually is high. Munster notes that if Apple sells 2.1 million units, it would represent growth of 38 percent. The big question: How did the MacBook Air sell?

Also see: Interview: Alex Wiley, creator of the gold MacBook

- iPhone units: Wall Street is expecting Apple to move 1.7 million units in the quarter, but the range is unknown: 1.3 million units would be disappointing and 2 million units would be cheered. AT&T on Tuesday gave no indicator of iPhone sales either way. The big question: Did anticipation of a 3G iPhone hamper demand?

- iPod units: Apple's iPod is the forgotten unit thus far in 2008. The quarter was back-end loaded due to iPod Shuffle price cuts. Wall Street's iPod unit guesstimate is about 10 million units.

Also see: Apple’s weak growth sister: The iPod?

- Component costs: Soleil Securities analyst Daniel Ernst notes that memory prices should benefit Apple's profit margins in the quarter. Richard Gardner, an analyst at Citigroup, adds that DRAM/flash memory prices fell 40 percent in the quarter.

- The effect of the weak dollar: Ernst made an interesting point. Apple will get a financial cushion from the weak dollar because it gets 38 percent of its sales abroad. But the real kicker: Domestic sales will benefit from tourists shopping at Apple's retail stores, which happen to be located in favorite traveler stomping grounds (New York and San Francisco). Anyone that has roamed New York knows euros abound--it's a shopping fiesta for folks across the pond.

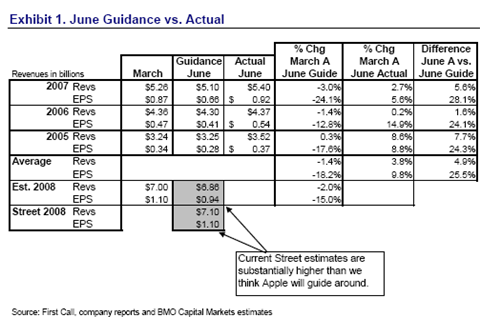

- The outlook: History suggests that Apple will be very conservative with its guidance and basically low ball Wall Street. BMO Capital Markets analyst Keith Bachman notes that Apple has a long history of being way low on its June quarter outlook. Part of this guidance game is that Apple can't predict the future of memory prices and likes to build in a cushion in case component prices jump. However, Apple's worries about component cost spikes have been unwarranted in recent quarters.

- This chart tells the tale. In other words, you can expect that Apple will cut its outlook. It's highly questionable whether you should freak out about it though.