Apple earnings: iPhone growth magnifies global smartphone potential

Apple once again took Wall Street by surprise when it reported second quarter earnings that far exceeded any expectations of analysts and industry watchers. Revenues came in nearly $1.5 billion over what Wall Street forecast and earnings were 90 cents over. Growth in Mac sales was impressive - at 33 percent - and iPod Touch sales were even better, up 63 percent from a year ago.

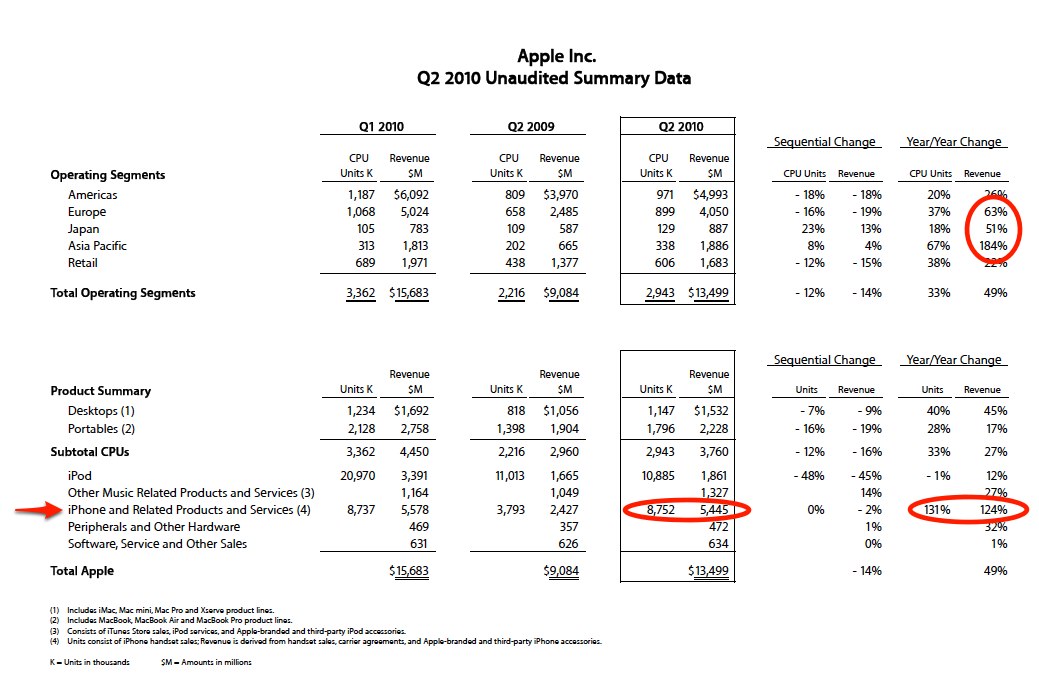

But the darling of the earnings call on Tuesday was the iPhone, which saw a whopping 131 percent year-over-year growth in sales and 124 percent jump in revenue. Its numbers exceeded the records set during the previous quarter, a holiday quarter. And sales were also up more than three times the 41 percent that IDC projected for overall smartphone market growth for the quarter.

So where's the sweet spot for all of this growth? That would be the international market - for Apple, that's Europe, Asia Pacific and, yes, specifically China, which accounted for about $1.3 billion of the $5.45 billion for global iPhone revenue. On Tuesday's earnings call, COO Tim Cook said:

If you look in terms of the geographies, we had some staggering growth rates, as you mentioned. If you look at Asia Pacific as an example, the iPhone units in Asia Pacific grew 474% year-over-year. Japan grew 183. Europe grew 133. So these are some fabulous numbers we're seeing, just incredible demand for iPhone.

The momentum is there and Apple is feeding it, adding eight carriers in key countries, including the UK and Ireland, as well as others in Asia. In all, the iPhone is available with 151 carriers in 88 countries today.

The smartphone game is young, though, and Apple is only one player on the bigger field. Research in Motion, the maker of the Blackberry, also has its sights set on the international market and is gearing up for announcements of its own in the second half of the year. In its fiscal Q4 earnings call with analysts last month, RIM co-CEO Jim Balsillie said:

China represents an exciting opportunity for growth for BlackBerry and we have been moving forward with our plans to expand in the region... We continue to build our relationship with China Mobile and increase penetration across a broad range of verticals including financial, legal, banking, professional service and manufacturing. We look forward to announcing more details our plans in China in the coming months.

He also noted that prepaid subscribers continue to increase as a percentage of the subscriber base with Asia Pacific, Middle East and Latin America leading the way.

Related: RIM's Balsillie on Blackberry's future: What? Me Worry?

For now, RIM is still the No. 2 player worldwide and continues to see gains in market share, up 3.3 percent to nearly 20 percent in 2009, according to Gartner numbers for the year. But Apple isn't far behind, jumping more than 7 percent in the same period, and Google is also making some strong gains with Android, up about 3.5 percent for the year.

As for that No. 1 spot, Symbian and Nokia still maintain their strong leads. But that Gartner report from painted a grim picture in the face of competitive pressure from Apple and RIM. From the Gartner report:

In the smartphone OS market, Symbian continued its lead, but its share dropped 5.4 percentage points in 2009. Competitive pressure from its competitors, such as RIM and Apple, and the continued weakness of Nokia's high-end device sales have negatively impacted Symbian's share. At Mobile World Congress 2010, Symbian Foundation announced its first release since Symbian became fully open source.

Analysts expect Symbian^3 to reach the first devices by the third quarter of 2010, while Symbian^4 should be released by the end of 2010. Matthew Miller says the UI is as slick as any other smartphone UI and that it can power some of the "most functional devices on the planet." If only Nokia and Symbian can crack the North American market, too.

Finally, Google - along with Apple - represent the two fastest-growing operating systems internationally. Despite the wild card about the impact of Google and China relations, it's hard to ignore Android, as well. As an OS partnered with multiple carriers and device makers, Android has also made some gains. In last week's earnings call, Jeff Huber, senior VP of engineering, said:

Android is now powering 34 devices which is up 70% quarter-over-quarter from 12 different OEMs and over 60,000 Android devices are sold and activated every day. Our whole mantra with Android is “open.” First the Android OS itself is open for partners to modify and extend on their own. Then the Android market for apps is open for apps is open for all developers which is driving a lot of growth and great apps. We are now at over 38,000 apps, up 70% quarter-over-quarter. The net effect is to make web-ready Smart Phones more widely available. It is helping drive a lot of mobile search and apps usage.

That brings us back to Apple. With the stars aligned this way - and the market share percentages shifting and growing the way they are, it's no wonder that the U.S. and a deal with other carriers hasn't happened yet. On the call, Cook explained that Apple has exclusive carrier agreements in the U.S., Germany and Spain.

Yes, it's true that Apple has seen unit growth acceleration and improved market share in countries where the company has gone from having an exclusive carrier to multiple carriers - but, Cook said, "that doesn't mean the formula works in every single case."