Apple: Is it really recession proof? Wall Street says no

Updated below: Morgan Stanley analyst Kathryn Huberty thinks that Apple can't outrun a slowing economy. And she's betting her estimates on it.

In a research note Monday, Huberty downgraded Apple shares from "overweight" to "equal weight" and lowered her price target to $115 from $178 on the theory that the company can't beat a PC unit growth slowdown.

Huberty's theory, which along with an RBC downgrade knocked Apple shares down 17 percent to a 52-week low, goes like this:

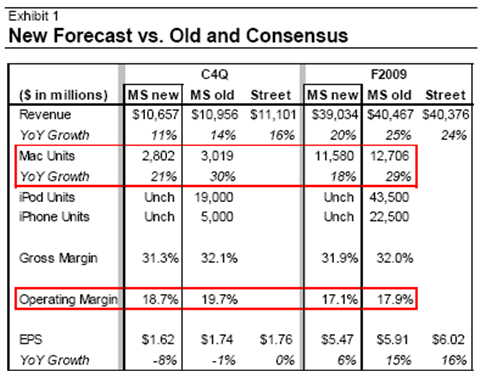

PC unit growth is decelerating. Here's how she is cutting her targets for Apple's December quarter.

The big source of growth in the PC market is sub-$1,000 units. Apple doesn't play the sub-$1,000 game. Analysts have been beating this netbook worry drum in recent days. Huberty's money quote:

Our proprietary analysis of US PC shipments by price segment suggests that unit growth is shifting to the low-end of the market (sub $1,000). With 69% market share of US consumer PC sales above $1,500, we don’t believe AAPL can continue to grow 3x the market rate near-term (which is what we believe is reflected in consensus models). Our revised Mac forecast assumes 18% YoY F2009 unit growth, down from 39% in F2008 (and our prior F2009 estimate of 29%). Going forward, we believe Apple’s ability to maintain both its unit growth premium (roughly 3x) and average selling price (ASP) premium (roughly 1.5x) versus the market is unlikely.

Apple's earnings growth will decelerate from a strong June quarter. Apple is expected to report fiscal third quarter earnings of $1.13 a share next month.

Investors are compressing earnings multiples for growth stocks. You only need a stock chart to figure that out. Here's Apple year to date.

Simply put, Apple isn't immune from what's happening in the broader economy. It all sounds logical, but Huberty acknowledges that Apple's "2-3 year market share story is intact."

Huberty also notes that Apple is likely to deliver a conservative December quarter outlook--a prudent move that's totally in keeping with the company's playbook. The big question is whether Apple's outlook will be more than its usual lowball guidance. We'll soon find out.

Also see: Apple cuts iPhone 3G build plan; Suppliers to take a hit

Update: Piper Jaffray analyst Gene Munster is defending Apple shares. Munster makes the following points in a research note:

- Wall Street expects Apple's unit growth to fall already. Munster adds that the current Apple quarter is facing a tough Mac comparison due to the launch of the iMac a year ago.

- Fear about about weak Apple margins are overblown. Munster says: "The Street is modeling for 32% gross margin in FY09, down from 34% in FY08. We expect margin guidance to be 30-31% for December, in line or above the company's 30% gross margin guidance for FY09."

- It's highly unlikely that Apple will warn about its September quarter results.

And all of Munster's points are couched in a massive caveat. He writes:

Concern over the US banking meltdown spreading to Europe, along with mass stock liquidations, looms large. We believe fears of a continued global slowdown will impact equity investments in the tech sector. But our thesis leads us to conclude that Apple is better positioned than other tech players to weather the storm.