Art of the software deal can get messy

Software buyers and vendors are increasingly butting heads amid a budget squeeze and increasingly aggressive sales tactics, according to Gartner.

In a series of presentations at the Gartner IT Symposium in Orlando, analysts walked buyers through a few negotiating tactics with the likes of SAP, Microsoft, Oracle, Cisco and a bevy of others. Taken as a whole the presentations provide a good overview of what IT buyers are facing these days.

At a high level, Gartner notes the following:

- Software renewals due in mid to late 2009 are being brought forward. That means some are billing earlier than normal for maintenance renewals.

- Maintenance costs are increasing and hard to reduce.

- Vendors are pushing unlimited enterprise agreements.

- Software audits are on the rise.

- Software as a service pricing is under pressure.

- Software vendors are under pressure to get deals signed and new deals are typically smaller and discounted.

Within those broad trends are a bevy of nuances in negotiation tactics. Here's a look at some of the themes when dealing with your favorite neighborhood software vendor.

SAP

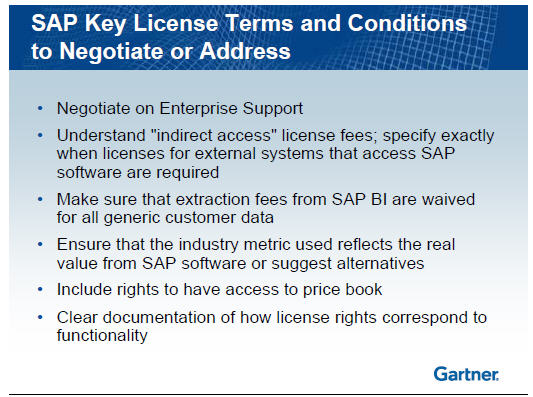

Gartner analyst Peter Wesche noted that SAP's business practices, not negotiated contracts, will lead to unexpected costs for many customers within three years of signing an initial license. Simply put, SAP can be difficult to deal with. SAP customers are challenged with shelfware, high maintenance, unclear licensing metrics and tough maintenance policies.Wesche notes:

SAP's business practices have changed over time, but have the common result of increasing SAP's revenue. Attempts to negotiate clauses in the contract to protect against surprises of unexpected cost are difficult because SAP generally pushes back against making any significant changes in its standard contract terms and conditions. Discussions that occur during negotiation between SAP sales representatives and their customers are often not documented as part of the contract, which then become subject to changing business practices rather than contract terms and conditions. It's important for SAP's customers to understand where the future risks will be in contracts with SAP so they can prevent unexpected costs whenever possible.

Wesche recommends that customers look beyond the overall discount to reduce SAP costs. Leverage your standing with SAP, vertical industry knowledge and different local policies in subsidiaries to get more out of the company. Wesche notes that customers should get rebundling protections to keep functionality and add-ons no matter how SAP repackages the software. Customers should also negotiate maintenance caps, which shouldn't increase at all in the first three to five years and then be indexed to inflation.

There's a lot more that can be largely summarized as the following:

Oracle

SAP isn't a picnic to deal with and the bad news is that if you jump ship to Oracle you get more of the same.To wit:

Sound familiar? Well it is. The game is to push maintenance revenue higher at your expense. Gartner analyst Jane Disbrow notes:

Oracle generally gives a higher discount when more money is being spent at one time. Organizations that want to negotiate fixed discounts based on future possible purchases generally do not get the same level of discount that can be obtained when licenses are actually needed. Also, Oracle tends to separate its sales force into technology, middleware and applications, with different application sales reps for the different products. Each discount will be based on the separate purchases. Push back on this attitude, because discounts should take into consideration the total the customer is spending.

In other words, bundle your Oracle buying process. It makes sense given Oracle has so many software products via acquisition. Disbrow did note that Oracle will discount heavily if you're also in talks with SAP.

Overall, Disbrow notes that Oracle doesn't give buyers much flexibility in terms unless they are spending a huge chunk of dough or willing to walk away. For many customers, the latter isn't an option. The end result: Price increases you're stuck with.

One of the more notable tips for Oracle buyers was to beware currency fluctuations. Disbrow writes:

Due to Oracle's global pricing and the devaluation of the U.S. dollar, Oracle has had to make significant reductions in pricing in some countries outside the U.S. This also created situations where customers outside the U.S. who purchased Oracle licenses based on higher price lists several years ago are now paying more in maintenance and support than they would pay based on current pricing. With this new price increase, this enables Oracle to modify price lists outside the U.S. and also protect its profitable revenue stream of maintenance and support. Customers in the U.S. and other countries with currency conversions stable against the U.S. dollar should negotiate for higher discounts to compensate for the price increase.

Among Gartner's other observations:

- Oracle audits are increasing and companies without good asset management find themselves out of compliance with license agreements.

- Oracle's unlimited license model locks you into its software even if you want to use other software in the future, say open source.

- Shelfware is a huge problem. Don't buy more software than you will install and have in production in 6 to 12 months. Also beware the big discounts for buying shelfware trick.

Microsoft

Gartner's message for dealing with Microsoft was pretty clear:- Know the moving parts and licensing schemes;

- Have a well-prepared team to negotiate;

- And dangle Linux over Microsoft's head to make it squirm.

Gartner analyst Frances O'Brien highlights the Microsoft licensing changes of late. Microsoft introduced two new enrollments to its flagship Enterprise Agreement: An enrollment for the application platform and the enrollment for core infrastructure. Licensing under those enrollments could save on licensing costs. In addition, Microsoft has dangled promotions for its enterprise subscription agreements.

Not surprisingly, the cost of bundles is less than individual components.

O'Brien adds that buyers shouldn't rush with Microsoft negotiations. She writes:

Good Microsoft deals require a lot of effort and prior planning. The normal process can't be hurried if you hope to arrive at a good decision. Typically, upon renewal of a Microsoft contract, you will be presented with a proposal that may seem to be a "fait accompli." However, this proposal may not reflect your specific requirements. Companies that are most satisfied with their Microsoft negotiations are the ones that go into the negotiation with a clear understanding of existing license entitlements, products deployed and usage of those products. Establish a negotiating team that includes representation from all of the business units that will participate in the resulting agreement.

This additional time should be used to understand Microsoft's various licensing schemes and see how they fit with your technology strategy over the next three to six years. In addition, companies need to know their software asset management processes so they know license rights, software usage, infrastructure and rollout plans. Ultimately, these items will point a customer toward one agreement with Microsoft or two and whether they need perpetual or subscription licenses.

And if all else fails remember Microsoft's competition. O'Brien writes:

The use of credible competition is always a good negotiating strategy. Although there has been a shortage of credible alternatives to Microsoft desktop products, the growth of Linux in the server market has had a considerable effect on OS competitive positions. Many companies have been successful with Linux deployments, and can use the threat of putting new applications on Linux as a credible negotiating lever.

Linux is just one lever. Oracle and IBM are also competitors to leverage. Microsoft hates to lose and you can use that to your advantage.