AT&T takes Verizon's best punch well; adds postpaid subs, activates 3.6 million iPhones

Updated: Worries about Verizon's iPhone hitting AT&T's financial results appear to be overblown. AT&T met Wall Street estimates for the first quarter and even added postpaid subscribers contrary to analyst projections.

AT&T reported first quarter earnings of $3.4 billion, or 57 cents share, on revenue of $31.2 billion, up 2.3 percent from a year ago (see preview).

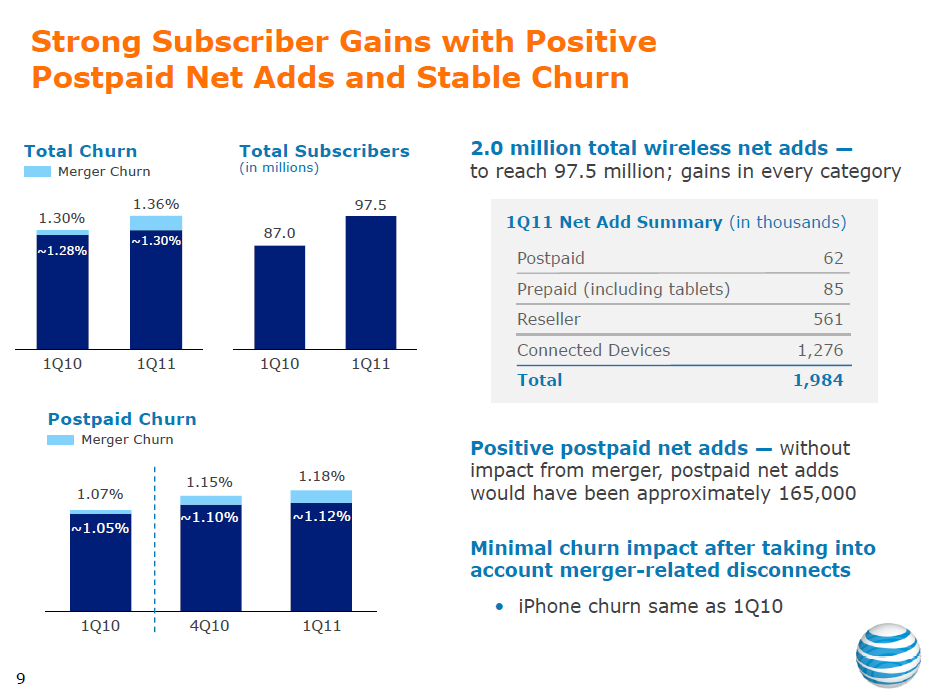

As expected, AT&T added subscribers due to tablets and e-readers. The big news here, however, is that AT&T added 62,000 net postpaid customers. That sum is well off previous quarters, but analysts were expecting AT&T to lose about 57,000 postpaid customers. Meanwhile, iPhone churn was stable. In other words, that mass exodus of AT&T iPhone users going to Verizon never happened.

AT&T CFO Rick Lindner said the impact of the iPhone going to Verizon had was "significantly less than feared" by the press, analysts and even the company.

Lindner, who is retiring, also did a little of chest thumping about AT&T's ability to fend off Verizon.

I think one of the most surprising areas, perhaps, is the fact that iPhone churn basically stayed flat. It did not increase. And I think as you think about what drove that and what caused those results, frankly I think it had less to do with customers being under contract. Of course, we always work hard with our upgrade policy to keep customers under contract and we do believe that it helps overall churn levels. But the fact is that it was well known for months and quarters in advance that another carrier would launch the iPhone. And yet, we continued to see customers upgrade their devices, enter into new contracts in the third and fourth quarters last year in record numbers, and that continued into the first quarter of this year when the phone was available on another carrier. And the reality is, even if customers were under contract, they had the ability to break that contract, pay a termination charge, and most likely take that device that they had and sell it and recover most, if not all, of that contract termination. So I don't think having customers under contract had that large of an impact. You have to remember the iPhone is a device that carries a lot of data usage and a lot of traffic. For heavy data users, being on our network, having a faster data experience, having simultaneous voice and data, having the ability to use that device not just in the U.S. but around the world, were important to the iPhone customer base.

AT&T also did a good job of diversifying its smartphone base. Of the smartphones added in the quarter, 40 percent of them were Android, RIM and Windows Phone 7 devices.

On a conference call with analysts, Ralph de la Vega, CEO of AT&T Mobility, said:

We also had a strong quarter with other smartphones, selling more than 2 million other smartphones this quarter. That's twice as many as we added in the first quarter of 2010. This was driven by BlackBerrys, Windows Phone 7 devices, and significant growth in new Android models. In fact, during the last six months, our monthly sales of Android devices have more than doubled. We still see a lot of upside here. About 46% of our postpaid base uses smartphones today, but our smartphone sales rate is approximately 65%. This quarter, we also began breaking out the number of branded computing subscribers added to our network. These are devices such as tablets, air cards, and netbooks.

Among the key data points:

- AT&T sold more than 5.5 million smartphones in the quarter. Of that figure, 3.6 million iPhones were activated. AT&T didn't break down whether these iPhones were iPhone 4 or inexpensive 3GS versions.

- The company added 322,000 tablets to its network in the first quarter and 421,000 connected devices overall.

- Churn in the first quarter was 1.36 percent, up a bit from 1.32 percent in the fourth quarter. Postpaid churn was 1.18 percent, up from 1.15 percent in the fourth quarter.

- AT&T added total wireless subscribers of 2 million. This figure includes phones, tablets, e-readers, security systems and fleet management systems.

Looking at AT&T's first quarter it's apparent that the company has taken Verizon's best punch with its iPhone.

In a statement, CEO Randall Stephenson, who has spent much of his time lately stumping for the T-Mobile acquisition, said AT&T is off to "a very solid start to the year."

Other key data points:

- First quarter capital expenses were $4.2 billion.

- The company had 97.5 million wireless connections in service. Of that sum 68.1 million were retail smartphone customers.

- Wireless revenue was $15.3 billion in the first quarter, up 10.2 percent from a year ago.

- AT&T added 218,000 U-verse TV subscribers and now has 3.2 million customers. U-verse broadband additions were 175,000 in the first quarter.

- AT&T business revenue was $9.3 billion, down 4.5 percent from a year ago. Business IP data revenue, however, was up 8.5 percent.