Barnes & Noble: NookColor, digital efforts hit bottom line hard; Payoff elusive

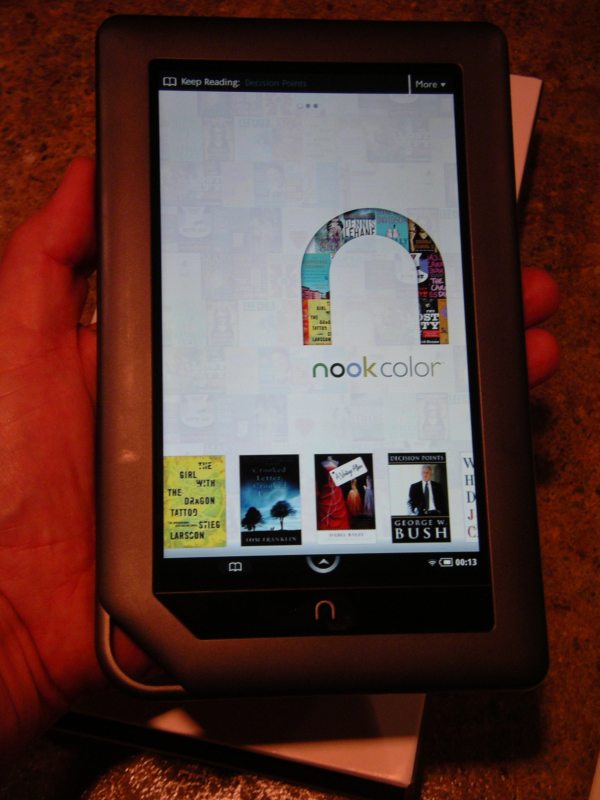

Barnes & Noble said Tuesday it will continue to invest heavily in its digital efforts such as the NookColor, Nook and various apps for its e-book store. The rub: That investment is translating into some serious red on the bottom line.

However, the company reported a second quarter net loss of $12.6 million, or 22 cents a share, on revenue of $1.9 billion. Wall Street was looking for a loss of 8 cents a share on revenue of $1.98 billion. This quarter was the second one in a row where the company significantly missed estimates. Barnes & Noble's same store sales fell 3.3 percent and its college bookstore same store sales fell 1.5 percent. On the bright side, Barnesandnoble.com same store sales jumped 59 percent.

Clearly, Barnes & Noble is a company in transition, but it has been aggressive in e-readers. The company estimates that its market share is 20 percent and should jump to 23 percent with the NookColor.

The company said its digital investments will peak in the second half of this fiscal year and then moderate in the years ahead. And for the payoff, Barnes & Noble said in a statement:

Payoff for these expenses is estimated to begin to appear in the third quarter, when NOOKcolor is expected to be one of the world’s most sought after eReaders, and in the third and fourth quarters, when NOOKcolor owners will begin downloading digital content, including books and magazines.

In the meantime, here's Barnes & Noble's outlook:

- Online same store sales will increase at a 75 percent clip for the third quarter and fiscal year.

- Barnes & Noble physical same store sales will increase 5 percent to 7 percent in the third quarter and be flat to up 3 percent for the fiscal year. The Nook is expected to drive these sales gains in the store.

- The company expects to deliver a third quarter profit of 90 cents a share to $1.20 a share. That projection falls short of the $1.29 a share expected by Wall Street. Fiscal year 2011 losses will be 75 cents a share to $1.15 a share.

The big question is whether investors will remain patient during the company's digital transformation.

See galleries and other coverage: