Broadband networks: Returns on invested capital stink

The last decade has been golden for telecom user, but network providers have barely broke even on their broadband buildouts.

That's the crux of a recent research note by Bernstein analyst Craig Moffett. His data, published in a book called "Capital Punishment," shows how it’s hard to build networks and even harder to get returns.

Moffett notes that the last 10 years have been great for consumers. Big phones have become small computers. Internet access is faster than ever and there are more television choices than ever. He writes:

As the decade of the 2000s drew to a close, the iPhone was already four years old, more than nine out of 10 Americans (including infants and the infirm) had a wireless phone, and smartphones — what had been "the next big thing" — were ramping toward ubiquity. Cable had captured one-quarter of the nation's residential phone business, broadband had soared to more than 60% household penetration, and the TelCos were delivering video to more than five million households.

And yet for all the technological strides the industry has made, the returns on invested capital, or ROIC, during the decade have been, at best, anemic. Even before considering the atrocious deals that mark the past decade of telecommunications, the business of building networks is so capital intensive that economic value creation by the group we cover here has been, in aggregate, barely positive.

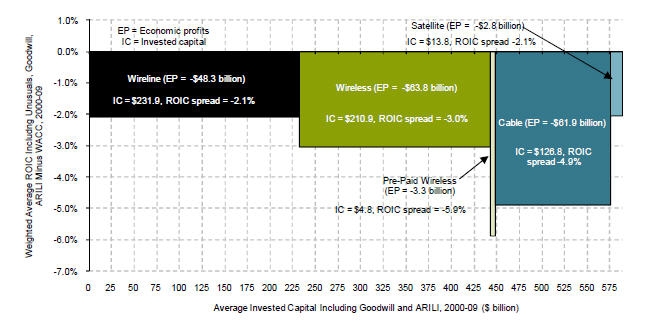

Wireline networks have the weakest returns on invested capital with a 1.5 percent gain over the last decade. Wireless networks had a meager return of 0.3 percent. Cable garnered a 2.5 percent return. Satellite networks had the best return on invested capital at 5.5 percent. It's no wonder that DirecTV shares have trounced other companies in 8-year returns. Others stocks---AT&T, Comcast, Dish, Sprint and Verizon---have negative returns.

But here's where the returns get tricky. Once you add up the costs of various telecom deals---MCI, AT&T, BellSouth etc.---the returns look much worse.

This chart illustrates the returns on invested capital once you include goodwill related to acquisitions.