Caught in the middle of an HP-IBM server brawl

There's nothing quite like getting caught in the middle of a server scrum between two technology titans.

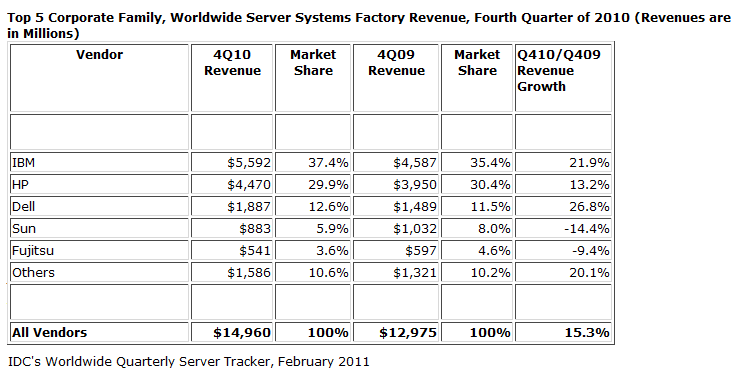

IDC released its fourth quarter server scorecard, which comes a few days after Gartner's, and the pitches from IBM and HP soon follow. You see IBM and HP are duking it out to be the top dog in servers.

Big Blue is benefiting from a surge in high end systems and new mainframes. HP is riding a blade server uptrend and a Windows server turbo boost.

IBM notes it is ripping out a lot of HP boxes. Sun is taking a hit too of course. HP pings me to let me know that it is also ripping out IBM boxes and replacing mainframes. In some cases, the two are bickering over a sliver of market share. My inbox is in the middle.

Here are the IDC numbers:

And the "behind the numbers" pitches from IBM and HP quickly ensue following IDC's data. Here's HP:

Hi Larry,

HP is #1 in total server revenue for CY2010 and gained significantly over our sometimes noisier competitors. This marks the first time ever that HP beat IBM in total server revenue for the full calendar year. And for 35 straight quarters, HP is the #1 leader in server units shipped. Below is our release that clearly states our leadership...(Ed note: IDC's chart shows IBM with the server revenue lead).

In HP’s last quarter alone (Oct. 31, 2010 to Jan. 31, 2011), HP drove more than 250 customer migrations from IBM mainframe, IBM p-series and Oracle/Sun combined.

In the full preceding year, the total number of migrations reached nearly 1,000. The majority of these migrations replaced and consolidated multiple competitive systems.

Oracle-Sun continues to represent the majority of competitive take-outs, with Oracle/Sun declining in revenue this year. Quarter over quarter, HP drove a 15 percent increase in IBM mainframe migrations – and a significant 25 percent increase in P-Series Migration.

According to a report just released from IDC, IBM's systems momentum continues. IBM gained more than 2 points of server market revenue share in the fourth quarter at the expense of Oracle and HP and reclaimed the market lead. IBM grew share in the midst of what IDC is describing as a non x86 driven recovery. IBM reclaimed the lead from HP in the fourth quarter of 2010 by growing server revenue by 21.9% resulting in IBM capturing 37.4% market share.

IDC also found that market for Unix servers showed positive growth for the first time in years. This growth was led by IBM Power systems, which grew revenue by 12 percent according to IDC, while Oracle experienced double digit revenue declines. IBM attained 53.9 percent market share in UNIX, a gain of 5.9 points of share. Oracle declined UNIX revenue by 24% and lost 5.3 points of share.

These results reflect IBM's focus on innovation and integration at every level of the systems stack -- from semiconductor technology through application optimization. We're beating competitors by meeting the demands of increasingly specialized, data-intensive workloads...

Add it up and the only thing IBM and HP really agree on is that they are both beating up Oracle and its Sun servers. These pitches go on all the time in services, in research and development and any other front where HP and IBM compete.