Cisco vs. HP: 3Com acquisition ups the ante

Cisco and HP have been duking it over their visions for the next generation data center architecture and the battle is just getting interesting. Cisco entered the server market and HP has countered by purchasing 3Com for $2.7 billion.

Simply put, both Cisco and HP have encroached on their rival's home turf. The 3Com purchase gives HP a foothold in security (3Com owns TippingPoint), switches and routers (statement, breaking news). HP also becomes the No. 2 networking vendor. Cisco CEO John Chambers foreshadowed the HP collision course back in August. He declared HP a clear foe.

Also: HP announces $2.7 billion acquisition of 3Com; raises outlook

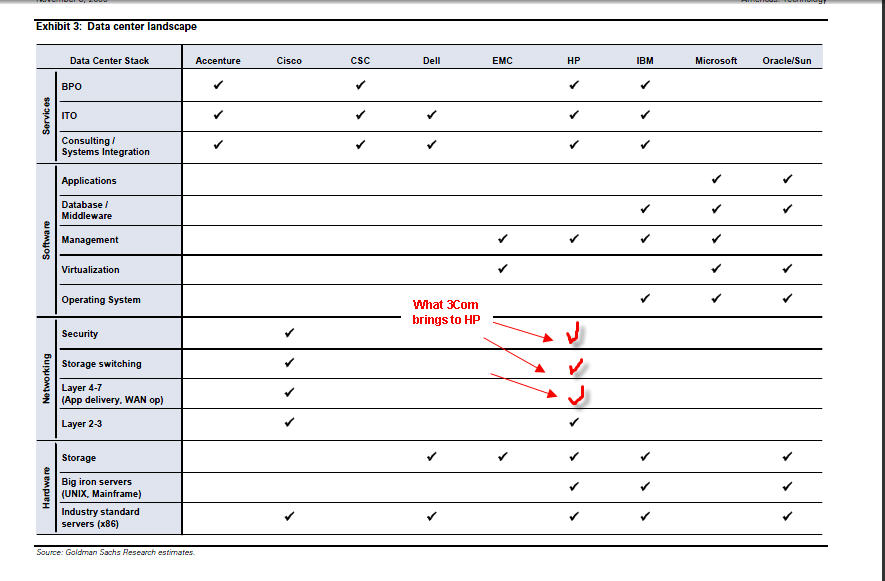

This chart from a Goldman Sachs data center report sums up how HP-3Com purchase changes the landscape (my notes added):

As you can see, HP's purchase of 3Com, which went for $7.90 a share or $2.7 billion, fills in a few key networking gaps for the company. The data center game plan for most vendors appears to revolve around offering a complete stack---ranging from servers to software to storage to networking and security. These various parts will ultimately work as one in the data center.

Chambers has been pretty clear that the data center will revolve around the network. On Cisco's latest earnings conference call, Chambers touted acquisitions as well as strategic alliances. Also: Cisco's beats for Q1; bullish on investments and recovery

I also believe that more of our customers are beginning to understand that the market adjacencies will in our view at first loosely and then tightly be coupled together from a technology and business architectural perspective, enabled by the common theme of the network becoming the platform for all forms of communications in IT. If the market adjacencies play out the way we expect, it will be very similar to what we saw with advanced technologies being viewed as standalone and then over time become loosely and then tightly coupled.

The HP jabs against Cisco were unmistakable on Wednesday. HP in its statement said:

"This combination will transform the networking industry and underscore HP’s next-generation data center strategy built on the convergence of servers, storage, networking, management, facilities and services."

Translation: HP isn't going to let Cisco dictate data center architecture.

"Companies are looking for ways to break free from the business limitations imposed by a networking paradigm."

Translation: HP wants to free you from Cisco (and lock you into HP of course).

"By combining HP ProCurve offerings with 3Com’s extensive set of solutions, we will enable customers to build a next-generation network infrastructure."

Translation: HP is hitting Cisco in its core business since the networking giant is targeting servers.

"We are confident that we can run our entire global business of 300,000-plus employees, including our next-generation data centers, entirely on the new HP networking solutions,” said Randy Mott, CIO of HP.

Translation: We'll eat our own networking dog food as a proof of concept.

While Cisco has a healthy respect for all of our competitors, acquisitions in our industry only validate the fact that networking is becoming the platform for all forms of communications and IT. As the leader in the networking market, Cisco is very confident in our business strategy, commitment to product innovation and ability to provide strategic business value to our customers in a highly competitive marketplace.

Add it up and the data center landscape is shifting into alliance mode. IBM will be pals with Cisco, Brocade, Juniper and any other networking vendor. Cisco will team up with EMC and VMware. HP is filling out its portfolio via acquisition.

What remains to be seen is whether HP's channel, services and distribution heft can challenge Cisco's 70 percent market share. This Goldman Sachs chart tells the tale:

Notice how neither 3Com nor HP were the vendors being invited to the request for proposal dance. It should be noted that both Juniper and Brocade are strong IBM partners. Will HP with 3Com be invited to upend Cisco going forward?