Citrix rides product cycle, large deals to strong Q3, ups outlook

Citrix landed 40 deals worth more than $1 million each to fuel strong third quarter results that blew away estimates. The company also upped its outlook for the year and projects more growth via a bevy of product announcements from its Synergy customer powwow in Barcelona.

The company on Thursday reported third quarter earnings of $92 million, or 49 cents a share, on revenue of $565 million, up 20 percent from a year ago. Non-GAAP earnings were 64 cents a share. Wall Street was expecting non-GAAP earnings of 58 cents a share on revenue of $544.8 million.

As for the outlook, Citrix also impressed Wall Street. For the fourth quarter, Citrix projected non-GAAP earnings of 75 cents a share to 76 cents a share on revenue of $610 million to $620 million. Wall Street was expecting earnings of 74 cents a share on revenue of $609.3 million.

In recent days, a bevy of technology companies have either reported disappointing quarters or cut outlooks. Given that fact, Citrix appears to be a standout. For 2011, Citrix said it was looking for non-GAAP earnings of $2.45 a share to $2.46 a share on revenue of $2.2 billion to $2.21 billion. For 2012, Citrix is expecting revenue to be in the range of $2.47 billion to $2.48 billion.

How is Citrix blowing through expectations?

For starters, Citrix is positioned in a few key sweet spots. Citrix has become a leading desktop virtualization player, is increasingly focused on software as a service and has a position for corporate mobility as workers bring tablets and smartphones into the office. Toss in a steady stream of strategic acquisitions---in recent months Citrix has acquired Cloud.com, ShareFile and AppDNA---and there's a formula for growth.

The numbers for the third quarter tell the tale:

- Product license revenue was up 28 percent.

- Online services revenue jumped 20 percent from a year ago.

- And deferred revenue was $834 million, up from $680 million a year ago.

On a conference call with analysts, Citrix CFO David Henshall said that customers are increasingly buying XenDesktop for desktop virtualization as well as back-end technology such as NetScaler. Rivals such as MokaFive have argued that Citrix is too costly because that front-end virtualization often means more back-end investment, but companies seem to be going for the bundles. For perspective, Citrix's 40 large deals in the third quarter was double the average in quarters a year ago. Henshall said:

We have some of the largest deals coming out of NetScaler as well as XenDesktop, and a surprising number of combined transactions -- those customers that are buying both a hardware and a software solution as well as customers are looking at both XenDesktop and XenApp standalone products as a component. I would also add that contribution from system integrators continues to move up.

Citrix CEO Mark Templeton said the company has positioned itself well for the move to mobility via products like Citrix Receiver and cloud computing. Templeton said:

Clearly we are building strong positions across SaaS, virtualization, networking , and cloud markets. And the investments we have made over the past year in people, infrastructure, innovation, and go-to-market is powering growth through geographical reach and business model diversity.

In addition, Citrix is positioning itself to be a larger cloud player going forward. At its Synergy conference in Barcelona, Citrix announced the following this week:

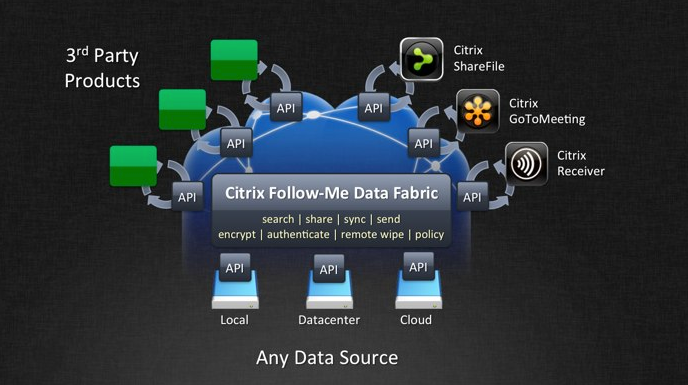

- A ShareFile Cloud effort that integrates data into other apps and services. The service, dubbed the Follow-Me-Data fabric, allows developers to incorporate search, shares, sync and remote wipe capabilities via APIs. Citrix Receiver and GoToMeeting will integrate Follow-Me-Data. Citrix's aim is to develop personal clouds for workers.

- CloudGateway, a unified service broker that delivers Windows, Web, SaaS and mobile apps to users on any device. The main features are app self-service, data policy, user provisioning, license and service level management and user provisioning.

- A move to put Citrix's HDX technology onto chips. The system-on-a-chip plan theoretically would expose virtual apps and desktops to more devices.

- New virtual desktop tools via the App-DNA acquisition. Citrix also stepped up efforts to bring desktop virtualization to SMBs.

- Cloud efforts such as connecting Citrix's NetScaler to more services and a portal to manage various public clouds. That latter announcement ties into Citrix's CloudStack platform, which was acquired via the Cloud.com purchase.