Comcast loses subscribers, but hurdles fourth quarter targets

Updated: Comcast reported Wednesday that its fourth-quarter net income fell 32 percent amid rising competition, slowing subscriber growth and an asset impairment charge totaling $600 million. However, Comcast handily topped Wall Street estimates.

For the fourth quarter, Comcast reported net income of $412 million, or 14 cents a share, down from $602 million, or 20 cents a share, it logged for the year-ago period.

Comcast's earnings were weighed down by an asset write-down on its investment in Clearwire, the wireless broadband Internet service provider jointly owned by Comcast, Time Warner, Sprint Nextel, Intel, Google and Brighthouse Networks. After taxes, the charge amounted to $378 million, or 13 cents a share.

Excluding the charge, Comcast earned $790 million, or 27 cents a share, for the quarter, up 31% on an adjusted basis. That beat earnings of 22 cents a share that was expected on average, according to a poll of analysts conducted by Thomson-Reuters.

Comcast reported a 9% increase in revenue to $8.765 billion, surpassing expectations on Wall Street for revenue of $8.64 billion.

Facing the toughest economic climate in its 46-year history, Comcast declined to provide its customary full-year guidance for 2009 (statement). The nation's largest cable provider opted instead to provide analysts on Wall Street with more details about recent trends in its performance, according to the Wall Street Journal.

"There's a bit less visibility in the business than usual," Comcast CFO Michael Angelakis said. "We intend to grow the business in 2009, but we are very focused on expanding our conversation with our investors and shareholders instead of just providing a couple metrics that everyone focuses on."

Weaker consumer spending, coupled with an advertising slowdown and new competition for television and Internet service from Verizon and AT&T weighed on the company's subscriber growth metrics across the board.

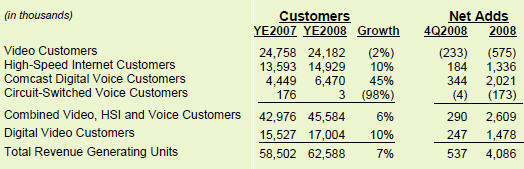

Here's a look at the customer count:

Simply put, it was a rough quarter for video customer additions. You can attribute that decline to the meltdown in the housing market and increasing competition from AT&T and Verizon.

Despite the slowdown, Comcast declared an 8 percent increase in its annual dividend to 27 cents a share from 25 cents, citing strong free cash flow (statement). Comcast's free cash flow in 2008 was up 56 percent from the previous year to $3.6 billion, but its fourth-quarter free cash flow declined by 14% to $864 million.

The company halted its share-repurchasing plan in the fourth quarter after warning investors it would reevaluate its buyback policies in November.

In 2009, Comcast said it will remain financially disciplined:

And the capital spending outlook:

Larry Dignan contributed to this post.