Dell: Corporate IT upgrade cycle fuels first quarter

Riding a cycle of corporate PC and server upgrades, Dell reported stronger-than-expected first quarter results.

The company reported net income of $441 million, or 22 cents a share, on revenue of $14.87 billion, up 21 percent from a year ago (statement). Given HP's strong results, Dell's earnings weren't that much of a surprise. Dell's non-GAAP earnings were 30 cents a share. Wall Street was expecting Dell to report earnings of 26 cents a share on revenue of $14.27 billion.

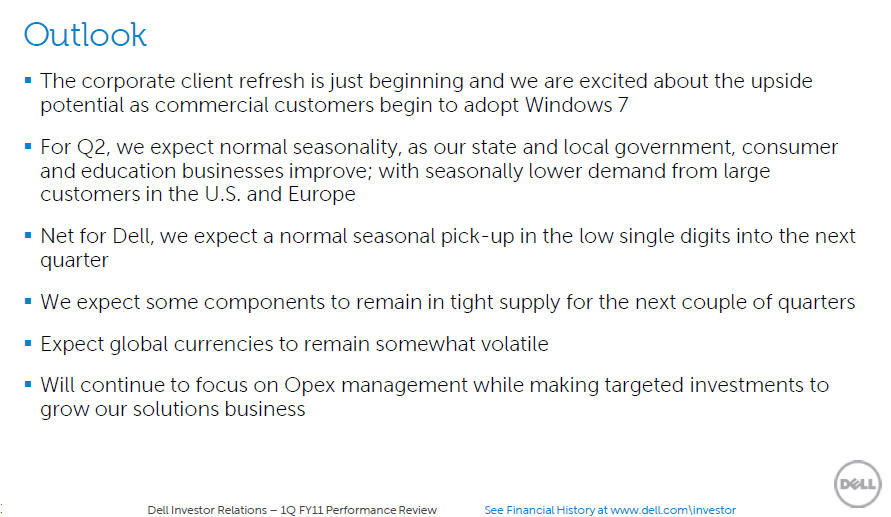

As for the outlook, Dell said that the second quarter is likely to resume normal seasonal patterns. That means sequential growth in the low single digits in the second quarter. The company also said that supplies remain tight.

In a statement, Dell said:

The company believes it is seeing the early stages of a corporate IT refresh. Commercial demand continued to build in the first quarter and Dell is optimistic the trend will continue throughout the year. Dell expects seasonal improvements from its state and local government, consumer and education businesses in the second quarter. But, the second quarter and the first part of the third quarter typically experience slower demand from larger commercial customers in the U.S. and Europe.

By the numbers for the first quarter:

- Gross margin for Dell was 16.9 percent, lower than Wall Street expectations of 17.72 percent. Non-GAAP margins were 17.6 percent.

- Mobility revenue was up 18 percent, sales in Brazil, Russia, India and China surged 60 percent and server revenue jumped 39 percent.

- Large enterprise revenue was $4.2 billion, up 25 percent from a year ago. Servers led the charge. Operating income was $283 million.

- Public sector revenue was $3.9 billion, up 22 percent from a year ago. Operating income was $298 million.

- SMB revenue was up 19 percent to $3.5 billion. Operating income was $313 million.

- And consumer revenue was $3.2 billion, up 16 percent from a year ago. The consumer unit squeaked out operating income of $17 million.