Goldman Sachs: BlackBerry, iPhone own smartphones, but if Apple ever gets an enterprise subsidy...

Goldman Sachs is increasing its smartphone forecast based on a consumer survey that reveals Research in Motion and Apple are the runaway winners in the field, but for vastly different reasons. RIM enjoys enterprise sponsorship, but iPhone's stealth business use campaign is working.

The survey in many respects confirms what anyone on an East Coast to West Coast knows. There are BlackBerry people and iPhone people and not much in between.

Generally speaking, Goldman Sach's survey of 300 high-end smartphone consumers found that iPhone garners more loyalty and satisfaction, but not enough to take a lot of market share from RIM. There's interest in Palm and Motorola is a no-show thus far.

The other tea leaves in the survey indicate that smartphone loyalty is higher than carriers. However, network quality is a big concern.

Add it up and Goldman Sachs sees smartphone units growing 12 percent in 2010, 22 percent in 2011 and 29 percent in 2012.

Among the key findings:

- Of the 300 consumers surveyed, 57 percent of them owned a BlackBerry (25 percent purchased with 32 percent enjoying an employer subsidy). Twenty-eight percent of respondents that didn't own a smartphone said they were inclined to go with a BlackBerry. Overall, enterprise spending and BlackBerry employer subsidies will boost RIM for some time to come.

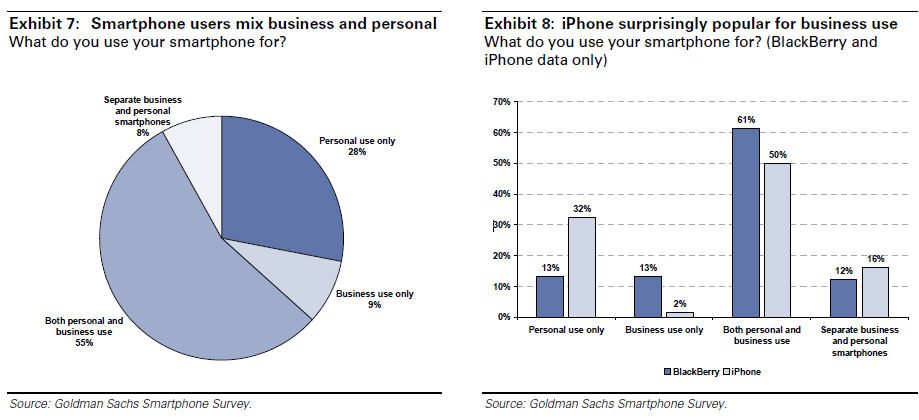

- Subsidies matter. Seventy-one of respondents said that their companies subsidized their BlackBerries. The comparable tally for the iPhone was 45 percent. Companies are introducing the BlackBerry to consumers. Employees are introducing the iPhone to their employers.

- Apple has good news and bad news, but most of it is very positive. Goldman found that three-fourths of current iPhone users plan on staying with Apple. And half of those expecting to upgrade to a smartphone are leaning toward the iPhone. On the downside, connections are the biggest complaint about the iPhone.

- Consumers rate carrier choice as the least important aspect of their smartphone. Add it the connection complaints and Goldman Sachs reckons that tiered pricing for data services is coming.

- iPhone is being used for business. This chart tells the tale. Simply put, smartphones are used for personal and business use. The difference between BlackBerry and the iPhone appears to be this: Corporations issue BlackBerries that are ultimately used for personal reasons. iPhones are bought for personal reasons first and then wind up for business use.

- Email remains the killer app for smartphones (that's why RIM is dominant). Texting, Web browsing and apps round out the top four killer features.

- Poor connections and download speed are the biggest complaints of iPhone users. For BlackBerry users the browser is a big complaint.

In sum, Apple will continue to gobble up smartphone market share, but RIM has a nice moat around its business. Other entrants in the market appear to be long shots for now.