Google earnings: A mixed bag but confidence about future

Google reported second quarter earnings today of $2.08 billion, or $6.45 per share, just short of Wall Street's estimates of $6.53 per share. It reported revenue of $5.09 billion, after deducting traffic acquisition costs of $1.73 billion. Wall Street had been expecting $4.99 billion in revenue. (Statement)

We saw strength in every major product area, as more and more traditional brand advertisers embraced search advertising and as large advertisers increasingly ran integrated campaigns across search, display, and mobile. We feel confident about our future, and plan to continue to invest aggressively in our core areas of strategic focus.

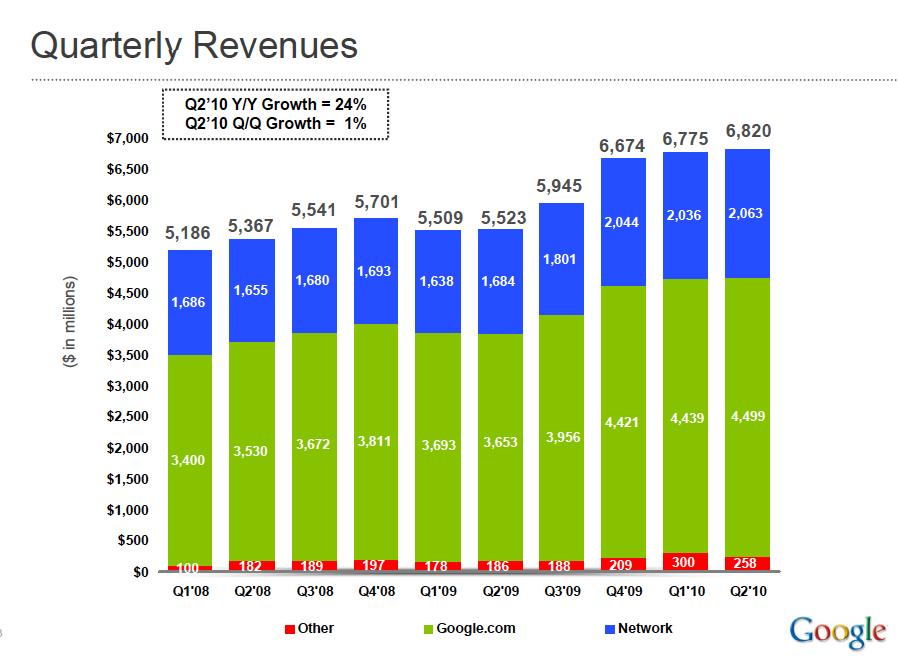

By the numbers, Google said that company-owned sites accounted for 66 percent of total revenues for the quarter, or $4.5 billion. Partner sites, thru AdSense, accounted for 30 percent of the revenues, or $2.06 billion. Both grew by 23 percent over the year ago quarter.

In a conference call with analysts, company CFO Patrick Pichette said the company is investing in growth areas, including search monetization, display, mobile and apps. In part, that includes acquisitions and hiring. During the quarter, the company grew headcount by about 1,200 - mostly in sales and engineering - bringing the total workforce to 21,805.

The company also touted the growth of the open Android ecosystem, noting that 165,000 Android devices are being activated daily, up from 65,000 last quarter. As for apps, the Android marketplace has more than 70,000 today, up from 30,000 in April.