Google earnings: Solid quarter shadowed by management changes

Google reported a solid fourth quarter today, an announcement that included news of major shift at the company's executive levels.

For the quarter ending December 31, the company reported $2.85 billion, or $8.75 per share, up from $6.79 for the year-ago quarter. Revenue was $6.37 billion, excluding traffic acquisition costs. Those costs, at $2.07 billion, represented 25 percent of advertising revenue. Wall Street had been expecting earnings of $8.09 per share on revenue of $6.05 billion. (Statement, Preview)

In a call with analysts, CFO Patrick Pichette said that Google delivered "excellent financial performance" for 2010 and, with a digital economy that "is clearly in high gear," the company is positioned to take on an "aggressive growth agenda." That means investments in key areas, such as compensation.

During the call, Pichette announced across-the-board salary increases of 10 percent for all employees, effective January 1, as well as changes that converts some bonus dollars for non-executive employees into salary increases. Pichette said the move is a strategic way to "attract and retain the best talent" but also warned that, with the hikes, come increases elsewhere, such as in 401(k) contributions and employee taxes. That will have an impact on quarterly results.

Jonathan Rosenberg, senior VP of product management, said the company repositioned itself in 2010, doubling down on some core areas - specifically search and search ads, as well as new ad formats. Innovation was a high priority and several new businesses were put to the test under a philosophy explained by Rosenberg:

...our philosophy is to encourage lots of innovation, and then we feed the winners and starve the losers. And this creates kind of a Darwinian but sort of Google environment in which new businesses emerge and grow, and in 2010 it is really clear that some new winners started to emerge.

Among them was display, now with more than 2 million publisher partners, and YouTube, which saw a doubling of revenue. And Android, of course, has become quite the force, with more than 300,000 devices being activated every day and mobile search from Android delivering a 10X year-over-year increase. In 2011, expect more of the same. And then some. Rosenberg said:

So what does all this mean for 2011? I think you can expect more of the same. We are going to double down again on the core of search and search ads. We are going to feed the 2010 winners -- display, YouTube, enterprise and Android -- and we are going to do it all with even greater financial rigor and cross-functional coordination all over the world.

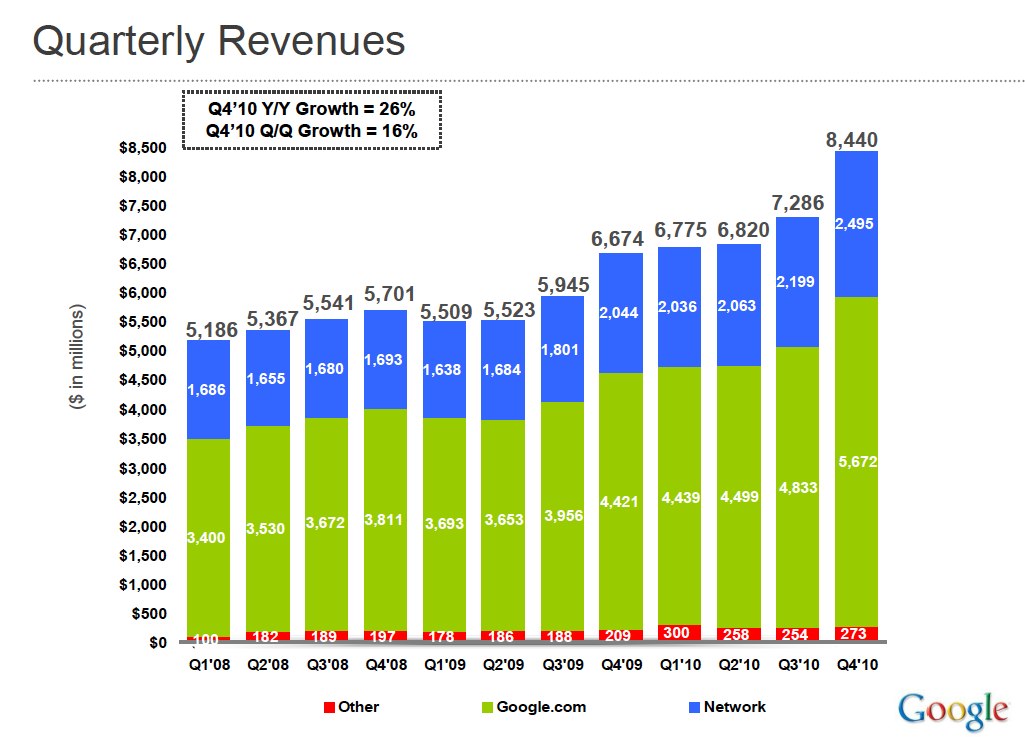

Here's a look at revenue growth:

And how Traffic Acquisition Costs have been on the decline, as a percentage of revenue:

During the call, Pichette also referenced the $1.9 billion purchase of a New York City building in December, referring to it as a wise investment in the company's long-term infrastructure, as well as its growth agenda.

Other highlights:

- Fourth-quarter revenue from Google-owned sites was $5.67 billion, or 67% of total revenues, and was up 28 percent over the year-ago quarter.

- Through AdSense, Google's partner sites reported revenue of $2.5 billion, or 30% of total revenues, up 22 percent from the year-ago quarter.

- Revenues from outside the U.S. were $4.38 billion, representing 52 percent of total revenue.

- At the quarter's end, Google had $35 billion in cash.

- Worldwide, Google employed 24,400 full-time employees, up from 23,331 at the end of the previous quarter.

Shares of Google were down slightly in regular trading, closing at $626.77. Shares were up in after-hours trading.