Google: Nice quarter, but...

Google's expense management enabled the company to handily top its earnings targets, but there were Wall Street worries about the company's lack of revenue growth. Revenue per click was also a worry.

The company today reported second quarter revenue of $4.07 billion, beating Wall Street's estimates of $4.05 billion, and income of $1.71 billion, or $5.36 per share, well above the estimates of $5.08 EPS that analysts had expected. Despite that, shares were dipping in after-hours trading. (Statement, Slides)

In a call with analysts today, executives offered a few highlights:

- Google's business appears to have stabilized - based largely on trends -, though CEO Eric Schmidt noted that it's too soon to say when the economic recovery will materialize.

- YouTube is now "on a trajectory that we're pleased with," with increased advertiser interest in the home page and an interest in pre-roll advertising for short clips.

- Increasingly, the number of Google searches are coming from mobile phones of all kinds and the company remains focused on innovation in mobile. The company is excited about the launch of about 20 android power phones being released by the end of the year.

- Executives also said they're excited about the development of Google Wave, a revolutionary communications tools unveiled at the company's developer's conference, and Chrome OS, a recently announced computer OS that has its eyes initially on the netbook market.

In a statement, Google CEO Eric Schmidt said:

Google had a very good quarter, especially given the continued macro-economic downturn. While most of the world's largest economies shrank, Google's year-over-year revenues were up 3%. These results highlight the enduring strength of our business model and our responsible efforts to manage expenses in a way that puts us in a good position for the economic upturn, when it occurs. We remain focused on investing in technical innovation to drive growth in our core and new businesses.

Highlights from the quarter include:

- Paid clicks were down 2 percent sequentially while costs-per-clicks were up 5 percent. From the year ago quarter, described as "healthy" by the company, paid clicks were up about 15 percent while average cost-per-click was up about 15 percent.

- Traffic Acquisition Costs, the portion of revenues shared with partners, was down to $1.45 billion, compared to TAC of $1.47 billion in the year ago quarter. TAC accounted for 27 percent of ad revenue, compared to 28 percent in the year ago quarter. TAC paid to AdSense partners was $1.24 billion.

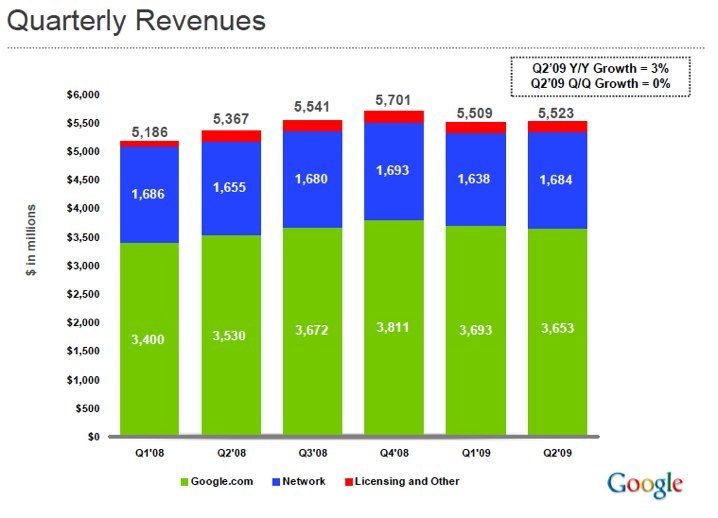

- Google's adjusted gross revenue, without deducting Traffic Acquisition Costs, was $5.52 billion.

- Revenue for Google-owned sites was $3.65 billion, or 66% of total revenues, a 3% increase over revenue for the year-ago quarter.

- Revenue for Google’s partner sites, through AdSense programs, was $1.68 billion, or 31% of total revenues, a 2% increase from the year-ago quarter.

- Worldwide, Google employed 19,786 full-time employees at the end of the quarter, down from 20,164. The company continues to hire, Schmidt said, noting that the reduction stemmed largely from reduction in sales and marketing positions previously announced.

Shares of Google were up slightly in regular trading, closing at $442.60. Shares tumbled in after-hours trading.