Google third quarter earnings strong; $700 or bust?

Google reported strong third quarter results Thursday, but it was unclear whether it was strong enough to propel the stock price to that $700 mark some analysts have been projecting.

After market close, Google reported revenue of $4.23 billion, up 57 percent from a year ago (earnings call transcript, statement, Reuters, Techmeme). Excluding traffic acquisition costs of $1.22 billion revenue was $3.01 billion. That topped Wall Street estimates of $2.94 billion, according to Thomson Financial.

As for earnings, Google net income of $1.07 billion, or $3.38 a share, up from $925 billion, or $2.93 a share, in the second quarter. Excluding items, Google reported earnings of $3.91 a share. Wall Street was expecting earnings of $3.78 a share.

I'd give you a stock price afterhours but it would be outdated in seconds. Up 10, up 15, down 9, down 5, flat--Geesh! In either case the revenue growth chart tells the tale.

In a presentation posted before the earnings call, Google made the following points:

- Ad quality remains strong;

- Improving search quality internationally;

- And Google is building out Google Apps.

By the numbers (all revenue figures exclude traffic acquisition costs):

- Google-owned sites accounted for 65 percent of total revenue, or $2.73 billion, with partner sites representing 34 percent of revenue, or $1.45 billion. Partner sites refer to Google's AdSense program.

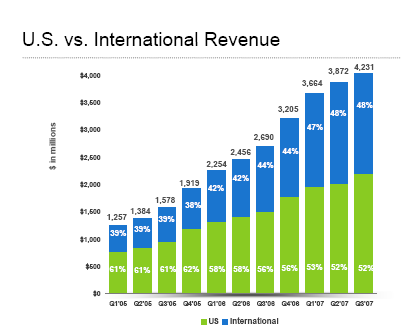

- International revenue was $2.03 billion, or 48 percent of revenue. Google benefited from a currency exchange bump and noted that if exchange rates were constant from the second quarter to the third quarter its international revenue would have been $24 million less. Google's United Kingdom revenue totaled $661 million.

- Operating expenses in the third quarter as a percentage of revenue were down a bit to 30 percent of revenue from 31 percent in the second quarter. In absolute terms, Google's operating expenses were $1.25 billion, up from $1.21 billion in the second quarter.

- Google spent $553 million in capital expenditures in the third quarter. Most of that was IT spending.

- The company had $13.1 billion in cash as of Sept. 30 and 15,916 employees, up from 13,786 employees as of June 30.

Updates from the conference call where everyone was "excited" yet sounded very monotone:

CEO Eric Schmidt:

- Said the future is search, ads and apps;

- Seasonal slowdown less than expected;

- Can deliver more value with new ad forms--widgets and video for instance;

- On apps side Google sees "massive transition" to cloud computing models. Believes that Google is on the cusp of a day where everything can be shared in the cloud.

Larry Page, president of products:

- Mobile ads "doing well" in Japan;

- 1 million books in book search and 27 partners.

Sergey Brin, president of technology:

- New ad formats are promising, especially gadget ads;

- Optimistic about Capgemini deal and apps adoption;

- Rounding out Apps suite.

Nuggets from Q&A:

- Google was pleased with partnership with MySpace, but it has been a lot of work and innovation. Social networks will require different kinds of targeting. "It's a challenge; there's so much inventory and it's very personal," said Brin. "There are a lot of things that make it hard."

- Executives were optimistic about iGoogle, but there are limits to monetization until partners develop apps and gadgets to plug into the platform.

- TV ads are not appreciated. Google executives said TV advertising is one of the few places where you can bring online accountability. Echostar partnership promising when it comes to figuring out TV ad targeting.

- Wouldn't comment on potential Facebook investment.

- On 700Mhz auction, Page said he was optimistic about the open terms of the auction, but was noncommittal on a bid. "We don't feel like there's a desperate need for us to bid to win," said Page. "The money isn't burning a whole in our pockets."

- DoubleClick deal. Premature to discuss timing of approval, but Google is doing all it can.

- Google has evaluated its hiring levels and corrected willy-nilly employee additions. However, the hires in the third quarter weren't affected--many of those folks were hired in the second quarter.