Google's Q1: Earnings strong, revenue a smidge off, stock split on tap

Google reported strong first quarter earnings that were better than expected, but revenue was a bit light. The company also approved a 2-for-1 stock split, but maintained a structure that leave control with founders Larry Page and Sergey Brin.

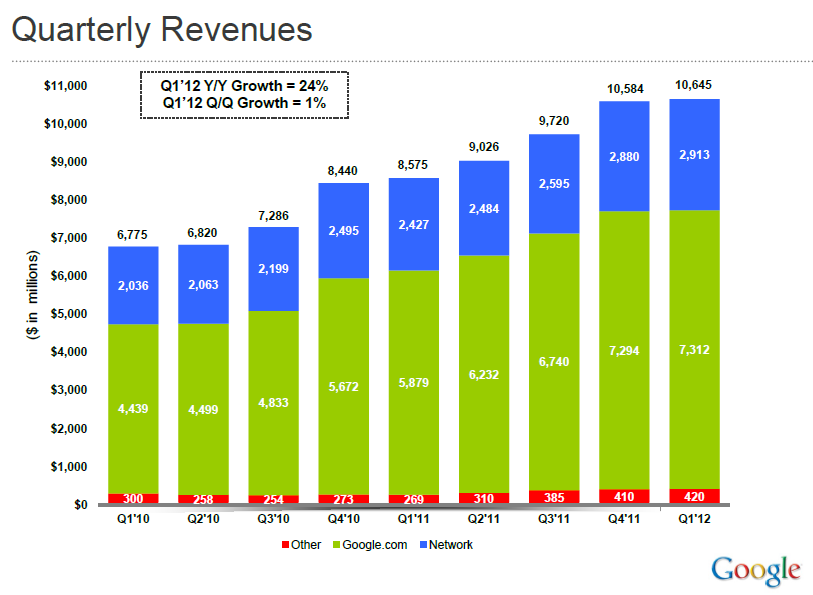

The company reported first quarter earnings of $2.89 billion, or $8.75 a share, on revenue of $8.14 billion excluding traffic acquisition costs. Including traffic acquisition costs Google revenue for the quarter was $10.65 billion. Non-GAAP earnings came in at $10.08 a share.

Wall Street expected Google to report first quarter earnings of $9.65 a share on revenue of $8.15 billion excluding traffic acquisition costs.

Cost per click rates were down 12 percent from a year ago. That decline was worse than expected and may reflect more mobile and tablet traffic.

Overall, the company was upbeat about its outlook. CEO Page in a statement called the quarter "great," touted 24 percent revenue growth and momentum of Android, Chrome and YouTube.

On a conference call, Page said that the company has improved its product velocity and has redesigned products throughout.

I've pushed hard to increase our velocity, improve our execution, and focus on the big bets that will make a difference in the world. Google's a large Company now, but will achieve more and do it faster if we approach life with the passion and the soul of a start-up. This has involved a lot of clean-up. We've given many of our products including search, a visual refresh so they now have a more consistent look and feel.

In afterhours trading, investors didn't sweat cost-per-click rates and cheered a stock split.

Key highlights from the conference call:

- Google will hold upfronts for YouTube in May just like traditional TV networks do.

- YouTube is seen as Google's premier display network. The company then layers in its demographic data behind it.

- The company said its research shows that online clicks can drive in-store sales on the e-commerce front.

- Google's stock split is complicated. The company is creating a third class of stock (Class C) that doesn't have voting rights. Page and Brin still control the company.

By the numbers for the first quarter:

- Google site revenue was $7.31 billion, up 24 percent from a year ago.

- Network revenue was $2.91 billion, up 20 percent. Revenue figures for site and network revenue include TAC.

- 54 percent of Google's revenue was international. U.K revenue was 11 percent of sales.

- Paid clicks were up 39 percent from a year ago.

- Other cost of revenue---read data center investment---were up 12 percent to $1.28 billion in the first quarter.

- Google employed 33,077 full-timers as of March 31.