Google's search juggernaut: Recession resistant after all

Numbers don't lie. And Google's numbers are indicating that the company's search business is holding up much better than expected amid a recession.

Google reported fourth quarter pro forma earnings of $5.10 a share on net revenue of $4.22 billion (statement, Sam Diaz's take, Techmeme). Google did take a $1.1 billion writedown for its investments in Clearwire and AOL, but overall the quarter was solid. Wall Street was expecting earnings of $4.96 a share on revenue of $4.12 billion.

However, the big story is that Google held up surprisingly well. In fact, that banter about the company being recession resistant seems to be legit.

Google CEO Eric Schmidt said on the company's earnings conference call that search ads are defensible because they deliver returns:

The results, we think, show that advertisers' value targeted measurable ads. In the fourth quarter advertisers invested where ROI was the highest, and it was online. That's one of the few really good stories in the past quarter. Our sales force went out to tell people it's really important to understand that revenue is what you need, and the quickest way to get revenue is to use targeted Google advertising and its strategy had worked very well for us.

And.

Now, looking at the economic situation which is on everyone's minds, in some ways Q4 was the easy part. After all, we had holidays, had excess inventory and so forth. Now we're in a situation, where last quarter we said it was going to be unchartered territory, it's now clear we're in a worldwide recession as everybody knows, rising unemployment, foreclosures, that sort of thing. But we don't know how long this period will last. We, obviously, hope it will be short, but we're certainly prepared to get through this, no problem.

Getting through the recession means Google is acting like a grown up company and cutting projects that don't work and watching costs closely.

Also see: Google grows up; Restructuring tweaks signal end of adolescence

Many observers that questioned Google's ability to weather the downturn are a bit surprised by the company's results. Although most people didn't expect Google to completely blow the quarter, they came away impressed with the company's results.Bernstein analyst Jeffrey Lindsay writes in a research note:

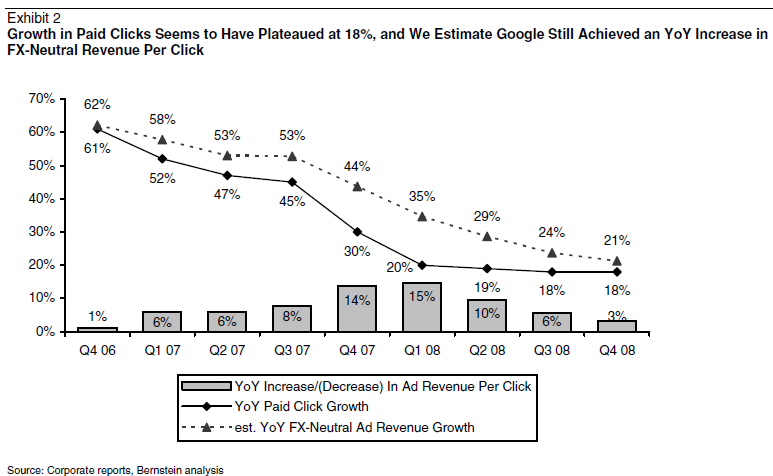

We think the real story here is that Google's paid search advertising model continues to show a high degree of recession resistance. Unlike display advertising—which we think has been negatively impacted by the current economic downturn—paid search still seems to be attracting advertisers. Google reported paid clicks had grown by 18% YoY, compared to total advertising revenue growth of 16% (the growth of Google's own business was 22% plus AdSense revenue growth of 4%), which would suggest that cost per click rates had fallen on average by approximately -2% YoY. However, this 16% is on a reported-in-dollars basis. If we adjust this for the currency headwinds experienced in the quarter, we believe that FX-neutral advertising revenue growth was actually closer to 21%, which would imply an increase in revenue per click. Overall, this was an impressive performance and confirmed that paid search has become the advertising platform of last resort for many advertisers.

Piper Jaffray analyst Gene Munster hit a similar theme:

The bottom line is that Google posted its second consecutive quarter beating estimates in a poor economy. We view Google's results as a testament to the company's continued relative strength in the most difficult of times.

Right now it's hard to argue with that assessment. Google executives acknowledged that 2009 is a total wild card, but Munster says that ad coverage is expanding.

We note that the biggest investor concern for 2009 is the decline of CPC levels. We expect CPCs to decline 13% y/y in 2009. However, we believe it is also important to consider growth in paid clicks, which we expect to exceed the decline in CPC levels at 19% y/y. The bottom line is that while CPC levels are a legitimate concern for investors, search query volumes in addition to ad coverage should increase and more than offset CPC weakness.