Handicapping the neutered Google-Yahoo ad deal

With the advertising deal between Google and Yahoo now in the Department of Justice's lap with restrictions two things are becoming clear. Yahoo will reap less revenue and Google is hanging in with a non-material deal to keep Microsoft out of the picture for a bit longer.

The rough outline of the revised Google-Yahoo ad deal does the following per the Wall Street Journal (Techmeme):

- The deal becomes a two-year pact instead of 10 years.

- The revenue Yahoo can garner from Google is capped at 25 percent of its search revenue.

- Google advertisers can also opt out of seeing their ads on Yahoo.

Now the handicapping begins. Piper Jaffray analyst Gene Munster reckons that Yahoo's near-term gains from the revised deal are still in tact. In other words, the amended Google deal can still provide Jerry Yang & Co. with a boost. According to Munster's estimates Yahoo will reap revenue of about $665 million under the revised Google ad deal instead of $800 million with operating cash flow of $200 million to $350 million instead of $250 million to $450 million.

Munster also sheds some light on why Google is still hanging around Yahoo despite the potential DOJ scrutiny:

As long as Google is in the picture for a search outsource partnership, it would seem like Microsoft is out of the picture. However, we note that Yahoo! board member Carl Icahn stated on CNBC last night that as a large shareholder, he believes eventually Yahoo! should do a search deal with Microsoft. We believe that if the Google deal were to dissolve as a result of pressure from the DOJ, Microsoft could re-engage Yahoo! in a search outsource agreement.

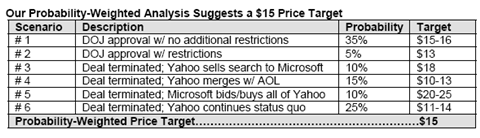

That take is certainly plausible. In fact, Microsoft is the only reason Google is bothering with Yahoo (the deal is not material to the search giant's earnings). Meanwhile, the revised deal changes the probability chart. Needham & Co. analyst Mark May outlines the following scenarios:

But the big question is what Yahoo will do at the end of this two-year Google deal. Yahoo may really only be postponing a tough decision on its search business. Also see: