HP seals EDS deal; Services No. 2 behind IBM; Can Hurd run EDS better?

Updated: Hewlett-Packard CEO Mark Hurd said Tuesday he plans to use a familiar playbook to integrate Electronic Data Systems: Leverage scale, squeeze costs -- and underpromise and overdeliver.

"We're running the playbook we know how to run very well," said Hurd, on a conference call with analysts. "We know how to get significant leverage out of our scale. We spent double-digit thousands of hours on the due diligence and planning. This thing (EDS) is very attractive. We didn't bake in a lot of revenue synergies, but they are there."

On Tuesday, HP officially announced that it is buying Electronic Data

Hurd's bet: That he can run EDS--a company that has had flattish revenue growth since 2000--better. When questioned about EDS execution, Hurd noted that the company had done a lot of heavy lifting on its long-term restructuring. "If we do get the cost synergies done--and we will--we think this thing has tremendous opportunity," said Hurd, who indicated that HP will get its synergies and deliver revenue growth with EDS.

Overall, Wall Street analysts were skeptical about the EDS purchase. What was truly stunning is that analysts weren't budging from their skepticism given that Hurd is a Wall Street favorite. Analysts asked Hurd why HP didn't acquire a smaller offshore player.

- The deal is expected to close in the second half of 2008.

- HP will create a new business group called EDS, an HP company. EDS will remain in Plano, Texas and be lead by current EDS CEO Ronald Rittenmeyer, who will report to Mark Hurd.

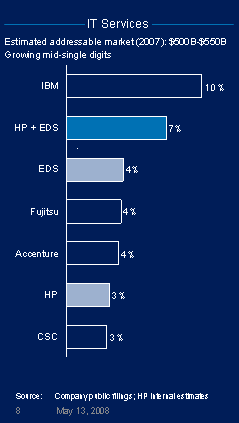

- HP will be the second largest IT services provider.

- HP said the transaction will be accretive to fiscal 2009 non-GAAP earnings and accretive to 2010 GAAP earnings. "Significant synergies are expected as a result of the combination," the company said.

- HP will pay for EDS with cash and new debt.

Also see: HP’s bid for EDS: Opportunity costs loom

"We will be a strong business partner," said Hurd, who on a conference call said the deal is important strategically and financially. Hurd also said he was confident that HP could execute on the integration of EDS and deliver savings and efficiencies.

HP and EDS executives played up the complementary nature of the two businesses (click for full slide):

Other key points from the conference call:

- Opsware will play a big role automating EDS and HP operations. EDS had been Opsware's biggest customer.

- Rittenmeyer said the deal will push EDS' zero outage initiative to a "new level".

- There is very little overlap between the two companies, said Hurd.

- "EDS had a strong applications outsourcing business and frankly we didn't," said Hurd.

- Analysts were skeptical about HP's opportunity costs related to the EDS deal.

- Analysts questioned the value of EDS and noted that many of its employees were based in the U.S. Rittenmeyer challenged that assessment and noted that many EDS customers are in federal, state and local government and can't use offshore resources.

- HP didn't discuss layoffs after the EDS deal, but Hurd said operating profits could be improved. That's a hint that there may be some workforce restructuring ahead.

To allay any concerns about the EDS deal, HP upped its second quarter outlook and fiscal 2008 guidance (statement). The company said second quarter earnings were 80 cents a share and 87 cents excluding items. Revenue for the second quarter was $28.3 billion, up from $25.5 billion a year ago. Wall Street was expecting earnings of 84 cents a share, according to Thomson Financial.

For the third quarter, HP projected revenue between $27.3 billion and $27.4 billion with non-GAAP earnings between 82 cents a share and 83 cents a share. GAAP earnings will be 76 cents a share to 77 cents a share. Wall Street was expecting third quarter earnings of 82 cents a share.

HP projected fiscal 2008 revenue between $114.2 billion and $114.4 billion with earnings of $3.30 to $3.34, up from its previous range of $3.26 a share to $3.30. Non-GAAP earnings are projected to be $3.54 a share to $3.58, up from its $3.50 to $3.54 range. Wall Street was expecting $3.52 a share.

While EDS boosts HP's services business dramatically, the company still has some holes to fill. This chart tells the tale:

Next up for HP may be a few business process outsourcing acquisitions.