HP vs. IBM: The looming IT services war

HP and IBM want your services business and the jockeying for position has already begun.

Later today, HP holds its analyst meeting where CEO Mark Hurd will provide a new financial outlook including the EDS purchase, which just closed, and outline the company's enterprise plan. In a nutshell, it's a blueprint to how HP is going to try and poach some IBM mojo.

So far, analysts are upbeat about HP's prospects. One analyst--Jeff Embersits of Shareholder Value Management--is so upbeat that he recommends a Hurd portfolio. This portfolio dictates that you buy HP shares and short competitors Dell, Kodak and Lexmark since rivals will get "run over by the Hurd." There's one problem: Embersits left off IBM.

Let's not get confused here. With EDS in the HP fold there's only really one competitor Hurd has in mind: IBM. Sure, HP's analyst meeting will feature a lot of talk about synergies and future cost cutting but strategically the purchase of EDS changes everything. HP vs. Dell is an interesting warm up act, but that battle has been won. Big Blue is the big target.

Louis R. Miscioscia, an analyst at Cowen and one of the best in the business, explains:

Many analysts are unwilling, or prefer not to look at the strategic aspects to this deal, which we believe are material and are only a few years out. Hardware is becoming more commoditized over time, thus services is a logical offset to this for a large IT company. Software/hardware outsourcing provides a stable revenue stream. Offshore software outsourcing still garners very attractive operating margins in the 17%-28% range. Finally, if the end goal is to approach the margin levels of IBM at 10% and Accenture 13%, with EDS and HP in the 2%-5% range, there would be room for improvement for many years to come.

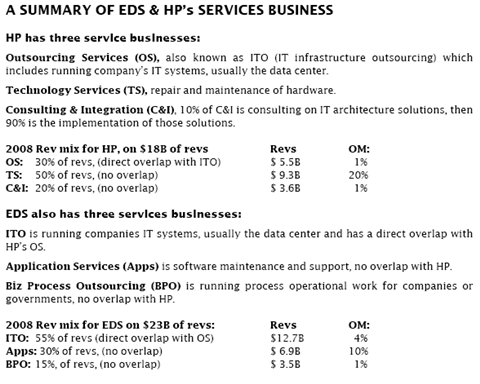

The plan for Hurd: Grab those lovely profit margins that Accenture and IBM enjoy. Here's the breakdown of the HP and EDS businesses via Miscioscia:

With HP's outlook it appears that a campaign is about to begin. IBM in its pitches to me floats the concept of "the future of services." The message: IBM is on the leading curve of IT services and HP isn't. IBM's strike is preemptive as HP's services business will get a lot more attention beginning today. Bill Shope an analyst at Credit Suisse is referring to HP's analyst meeting as the big show. If HP can integrate EDS well--I see no reason to believe Hurd can't--then the company can start making life difficult for IBM.

Big Blue, however, won't go quietly and there are plenty of question marks about HP's services model. The biggest question is whether HP's Agility Alliance. The Agility Alliance was cooked up by EDS to compete with IBM. Partners include Microsoft, Oracle, SAP, Sun, EMC and Xerox. EDS recommends its partners' hardware and software in return for a services recommendation. Shope asks a valid question: Will this alliance hold given that EMC, Xerox and Sun compete with HP?

Rest assured IBM will raise that question--repeatedly.

The other strategic shift for IBM is painting HP into the hardware maintenance and offshore outsourcing corner while elevating its profile to be more analytical. Case in point: IBM on Monday announced "a blended human capital management services and software package" that integrates the purchase of business intelligence software company Cognos with services. The general idea: Provide operational dashboards to everyone with services built around improving metrics. This dashboard meets services theme also popped up when talking to Big Blue about its green computing plans.

Bottom line: The IBM vs. HP on IT services is really a political campaign that's just kicking off. And unlike Obama vs. McCain there is no hard stop. The campaign for your IT services budget will continue for years to come. Sam Diaz will report later on HP's analyst meeting and I'll be following up with IBM's approach.