IBM: 2012 outlook solid, 2015 roadmap on track

IBM reported fourth quarter earnings were solid, but revenue was lighter than expected. The company's 2012 and 2015 outlooks remain on track.

Big Blue reported fourth quarter earnings of $5.5 billion, or $4.62 a share. Non-GAAP earnings, which excludes charges and other items, were $4.71 a share.

Wall Street was looking for fourth quarter earnings of $4.62 a share on revenue of $29.7 billion.

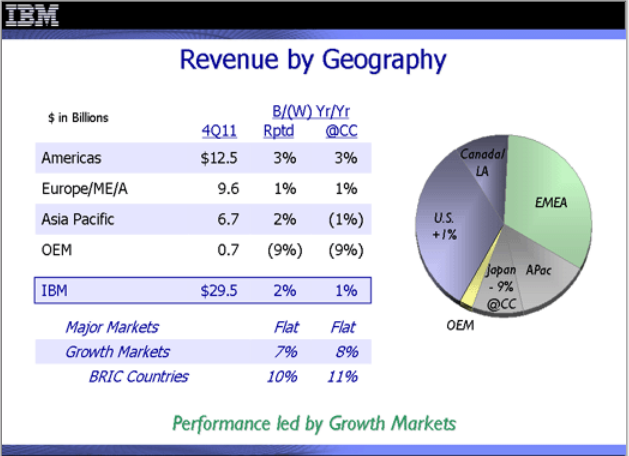

For the fourth quarter, revenue was up 4 percent. CEO Ginni Rometty, however, said that the company is on track toward delivering 2015 operating earnings of $20 a share. Wall Street was watching to see if Rometty would stick with IBM's 2015 view.

As for IBM's outlook, the company projected 2012 earnings of $14.85 a share on a non-GAAP basis and $14.16 a share GAAP. Wall Street was looking for earnings of $14.82.

By the numbers for the fourth quarter:

- Services revenue was up 3 percent to $10.5 billion. Business services revenue was $4.9 billion. Services backlog was $141 billion.

- Software revenue was up 9 percent in the fourth quarter to $7.6 billion. Operating income was $3.7 billion. Middleware revenue was $5.2 billion, up 11 percent.

- Revenue in the BRIC countries---Brazil, Russia, India and China---was up 10 percent.

- Hardware revenue was $5.8 billion, down 8 percent from a year ago. Operating income was $790 million, down 33 percent. IBM was coming down from a mainframe upgrade cycle.