Intel buys Wind River; Targets software for embedded devices

Intel said Thursday that it would acquire Wind River, which makes software for embedded devices, in a deal valued at $884 million. With the move Intel is making a move to diversify into software and away from its dependence on the PC and server markets.

The chip giant said in a statement that it will pay $11.50 a share in cash for Wind River, which closed at $8 on Wednesday.

The purchase is interesting on a few fronts:

- Wind River bolsters Intel's embedded software strategy;

- The purchase indicates that Intel thinks its future growth is in embedded devices such as smartphones, in-car systems and mobile Internet devices;

- And "Intel everywhere" is going to include software that runs behind the scenes to connect devices.

- With Wind River, Intel will have customers in the aerospace, industrial, networking equipment and consumer electronics verticals.

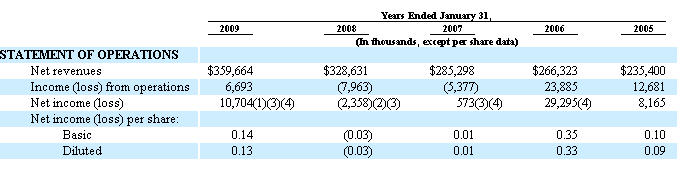

Wind River has about 1,600 employees and annual sales of $359.7 million. The company's operating system, VxWorks, goes with middleware and design tools used for embedded devices. Wind River counts BMW, Boeing, NASA, Northrop Grumman, Sony and others as customers.

Those industrial strength customers will give Intel new markets to target. Wind River will also give Intel a broader competitive set. Notably, Intel will now compete with Microsoft. From Wind River's annual report:

Our primary competition comes from internal research and development departments of companies that develop device systems in-house. In many cases, companies that develop device systems in-house have already made significant investments of time and effort in developing their own internal systems, making acceptance of our products as a replacement more difficult. Additionally, many of these in-house departments may increasingly choose to use open-source software, such as the Linux operating system. We also compete with independent software vendors and, to a limited extent, with open-source software vendors. Some of the companies that develop device systems in-house and some of these independent software vendors, such as Microsoft Corporation, have significantly greater financial, technical, marketing, sales and other resources and significantly greater name recognition than we do.

It's also unclear how the Intel purchase will affect Wind River's partnerships with chip makers. Wind River in its annual report touted its strategic relationships with chip makers such as ARM Holdings, Broadcom, Freescale, IBM, NEC, Qualcomm, Sun, Texas Instruments and Xilinx. Many of Wind River's partners compete with Intel.

In any case, Intel's heft may be able to turbocharge Wind River's growth as the embedded software market grows. Here's a look at Wind River's financial results for the last five years: