Intel shines: Earnings, revenue, margins well above estimates; Outlook better

Intel on Tuesday delivered an impressive second quarter relative to Wall Street estimates and didn't disappoint on its outlook either.

The company, which predicted a bottom in its first quarter results, delivered strong results across the board. Intel reported net income of $1 billion, or 18 cents a share. That sum excludes a European Commission fine of $1.44 billion. If you include the EC fine, Intel lost $398 million, or 7 cents a share. Revenue for the second quarter was $8 billion, down $1.4 billion from a year ago.

But the real story for Intel this quarter was its gross margin line, the one that garnered the most Wall Street focus. Intel said its gross margin for the second quarter were 50.8 percent. According to Thomson Reuters, analysts were expecting gross margins of 46.37 percent in the June quarter and 49.76 percent for the September quarter.

Meanwhile, Intel delivered a solid outlook---relative to expectations. It projected revenue of $8.5 billion, give or take $400 million with gross margin of 53 percent with 2 percent leeway. For the third quarter, Wall Street is expecting earnings of 16 cents a share on revenue of $7.81 billion.

Shares surged about 7 percent in after-hours trading.

For the year, Intel refrained from specific guidance, but didn’t indicate that spending would be $10.6 billion to $10.8 billion, up from its prior outlook. Capital spending will be $4.7 billion give or take $200 million, down from $5.2 billion in 2008.

In a statement (Techmeme) Intel CEO Paul Otellini said:

Intel’s second-quarter results reflect improving conditions in the PC market segment with our strongest first- to second-quarter growth since 1988 and a clear expectation for a seasonally stronger second half.

On a conference call with analysts Otellini made the following points:

- Channel inventory was in good shape, but overall levels were lower than the company liked.

- Overall consumption is recovering (especially in consumer notebooks).

- Intel customers are expecting a seasonally stronger second half.

- Enterprise demand remains weak and Intel wasn't expecting a big hardware refresh cycle. However, companies will have to refresh at some point since PCs, notebooks and servers are getting long in the tooth.

- Otellini said channel inventory was in good shape. Overall consumption is recovering for consumer notebooks. Inventory is refilling to normal levels. General view of customers are expecting a seasonally stronger second half.

- Enterprise customers will do deep evaluations on Windows 7 in August and September to prepare for buying in 2010.

- Intel does expect a server buildout over the next few years given the data center buildouts for cloud computing.

Keep in mind that Intel's results are down a bunch from a year ago, but given the tech industry is fishing for a bottom the news is likely to be viewed as a net positive.

Intel has been working to diversify away from the PC market and last month gobbled up Wind River, which makes software for embedded devices.

By the numbers:

- Average selling prices in the second quarter were down from the first. ASPs were also down including Intel's Atom chip for netbooks.

- Atom revenue was $362 million, up 65 percent from the first quarter.

- Inventory was down $240 million in the second quarter.

- By geography, Asia-Pacific represented 55 percent of sales in the second quarter, up from 51 percent in the first quarter and year ago quarter. Asia-Pacific was followed by 21 percent in the Americas, 14 percent in Europe and 10 percent in Japan. Europe sales fell from 18 percent from the first quarter and year ago quarter.

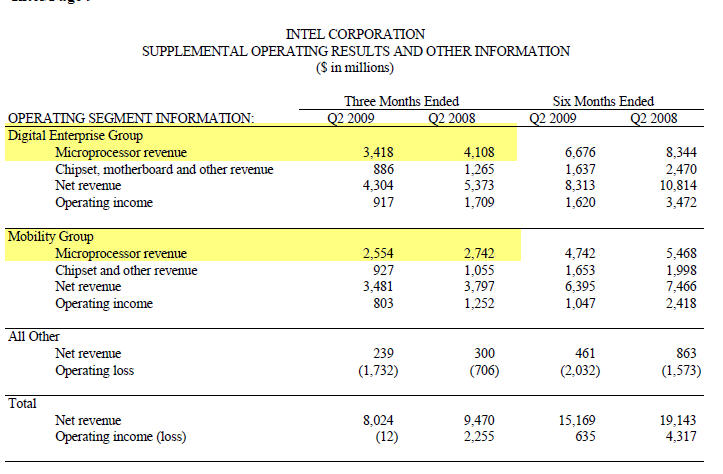

- The mobility group was Intel's best performer with second quarter revenue of $2.55 billion, down from $2.74 billion a year ago. Relative to the enterprise group the decline was tepid. Enterprise chip revenue was $3.42 billion, down from $4.1 billion a year ago.

- The company ended the second quarter with $11.3 billion in cash, short-term investments and marketable debt securities.