Intel talks ultrabooks, mobile, but future rides on data centers

Intel can talk ultrabooks, energy efficient screens and smartphones and tablets forever, but the company's growth rate still rides with the data center.

At the Intel Developer Forum this week, the focus was clearly on the evolution of the PC. Intel touted a partnership with Google so Android and Intel chips will work well together and plans to be a tablet player.

Simply put, there are wild cards about almost everything Intel executives spoke about this week. Can Intel crack tablets and smartphones? Can Intel's architecture compete with ARM? Will ultrabooks really juice PC sales? The list goes on.

In fact, the only certainty about Intel---that its server chips happen to run the data centers and cloud infrastructure that serves up all of these trendy apps---was largely ignored.

JMP Securities analyst Alex Gauna said in a research note:

Data Center momentum remains a bright spot for the story, and the company strove to dispel speculation that the Romley upgrade cycle is being delayed in stating that the company is already shipping next-gen server ICs for revenue, that HPC deployments will happen this year, and that enterprise solutions will be ready in 1Q12. The combined demand effect is expected to exceed the last major refresh by 20x, although it is not entirely clear how this is measured or phased in.

It's almost comical how much of the focus on Intel revolved around smartphones and tablets given how little revenue is involved. Sure, you need future products to wind up developers, but let's get real about what's paying the bills. For Intel, PCs---form factor under construction---and servers pay the bills.

If you assume that there's a post-PC era about to get started, Intel's data center business will become even more important. Today, Intel's data center group accounts for roughly 19 percent of the company's total revenue for the six months ended June 30. That tally was second behind the PC unit (65 percent of sales). If ultrabooks don't save the day that ratio will shift toward the data center side of the business.

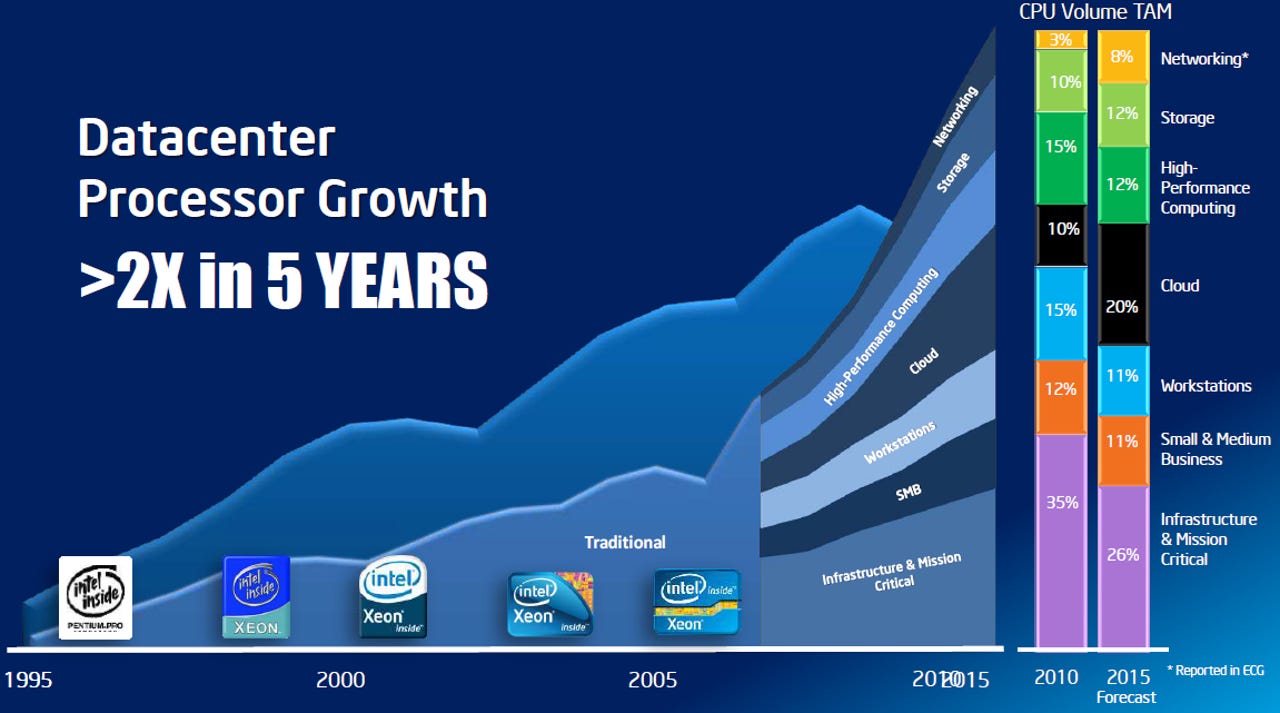

Kirk Skaugen, head of Intel's data center group, said that the chip giant plans to double volume by 2016, grow its storage and networking business at a 30 percent compound annual growth rate and grow its HPC (high performance computing business).

Those targets sure beat scrapping for margin and market share with the likes of Qualcomm and Nvidia on smartphones and tablets.

Intel's tasks for the next few years look like this:

- Reinvent the PC so the company can sell more chips.

- Dent the tablet and smartphone market.

- And grow the data center business like crazy.

The only sure bet is that last one. There was almost an inverse relationship between what Intel highlighted this week and actual growth prospects.

- Self-refreshing displays save battery life

- Intel: Ultrabook will 'transform' PCs, Haswell will complete 'revolution'

- IDF 2011: Intel talks Ivy Bridge Ultrabooks, shows working Haswell chip

- IDF: Intel shows off liquid cooler, DX79SI motherboard for Sandy Bridge-E processors

- Video: Intel, Google partner on optimized Android phones

- Intel CEO: Era of ‘ubiquitous’ computing is here

- Intel is a fast growing software company…

- Intel’s Otellini talks up Ultrabooks

- Intel readying Core i7-2700K CPU to spoil AMD Bulldozer launch?

CNET: