Is AOL a viable option for Yahoo against Microsoft?

Yahoo's board met over the weekend and reportedly decided to chat with both Microsoft and Time Warner, who could unload AOL in some sort of deal. My initial reaction: What would AOL really bring to Yahoo other than a migraine? But when you check out Comscore's latest ranking of Web sites and ad networks perhaps there's more to AOL than meets the eye.

But that doesn't mean AOL doesn't make sense on some level. Admittedly, pondering an AOL-Yahoo deal takes a bit of a leap. You have to assume that AOL can become nimble once it's extracted from the Time Warner empire. You have to assume that AOL's cratering subscription business can be extracted from any financial engineering. You have to assume Yahoo could do something with AOL. And you have to assume that there's more to AOL than what you can find in SEC filings. In other words, you have to buy into the idea that AOL can juice its advertising growth from the 18 percent clip it enjoyed in 2007.

Here's a look at AOL's annual ad revenue over the last four years:

- 2007: $2.23 billion

- 2006: $1.88 billion

- 2005: $1.34 billion

- 2004: $1 billion

That growth isn't exactly Google-ish. In fact, AOL's ad revenue is eclipsed by the subscription business, which is cratering by design. AOL is trying to be an advertising juggernaut.

But back to the original question: Is AOL useful to Yahoo beyond just annoying Microsoft?

Comscore's March statistics released Monday weave an interesting tale. Consider the following:

- Yahoo sites had 139.5 million unique visitors;

- Google had 137.5 million;

- Microsoft had 121 million;

- AOL had 111.8 million.

If you assume no overlap a combined Yahoo-AOL would have more than 251 million unique users a month. Microhoo would have 260.5 million. In either case, Yahoo with either Microsoft or AOL would make the company top dog in traffic.

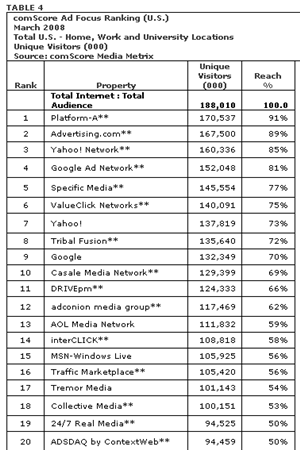

But traffic doesn't mean much of anything if you can't monetize it. And here's where an AOL-Yahoo deal could get interesting. According to comScore's ad focus ranking AOL properties own the top two spots followed by Yahoo. AOL's Platform A and Advertising.com have reach of 91 percent and 89 percent respectively. Yahoo has an ad reach of 85 percent. Further down the list you find that AOL's Media Network has a reach of 59 percent and AOL has a reach of 49 percent. Comscore defines reach as the percentage of the total Internet population ($185 million) that viewed an entity at least once in March.

In terms of ad networks, a Yahoo-AOL deal would result in multiple ad networks that could roughly equate to blanket coverage. Again the question will be whether all of these properties could enhance monetization. Based on Comscore's ad focus rankings Google's Ad Network and Google has reach of 81 percent and 70 percent, respectively, but in profit's the search giant has no peer on the Internet.

If--and it is a big if--these networks can be coupled intelligently a combined Yahoo-AOL may generate some value. But the real value of AOL to Yahoo becomes clear when you consider Microsoft's rankings. Microsoft's MSN-Windows Live has 56 percent reach on Comscore's ad rankings. If Yahoo works a deal with AOL instead of Microsoft the software giant is left behind. That fact explains the buying panic Microsoft has for Yahoo. Without Yahoo, Microsoft is hurting on the advertising front.

Bottom line: AOL may not be the best move in the world for Yahoo, but it's clearly one that could scare Microsoft into raising its bid.