Leapfrogging Dell, Everdream and salesforce.com

Fellow ZDNet blogger Josh Greenbaum is not a fan of salesforce.com. He believes the company is over-hyped, egomanical and expensive for partners. In contrast, Everdream, recently acquired by Dell, is a model SaaS company for partners, he said. In his recent blog post Josh wrote:

.....I believe that Everdream is successful, in a way that Salesforce.com so far is not, because Everdream has eschewed a hype-driven and very expensive partner model, with splashy conferences and high fees, for a more workman-like platform/partnership model that is basically all about finding the best way to get real partner product in front of real customers. It probably helped that Everdream, as a start-up, is actually much smaller than partners such as Symantec and McAfee (and WebEx, which has a business-process outsourcing partnership with Everdream): this forced Everdream to design a platform and business model that was obviously in the partners’ interest, as opposed to the ego-system that Salesforce.com has built, which is so far largely about aggrandizing Salesforce.com, with little left on the table for its partners.

To put it simply, Josh's assessment of salesforce.com and Everdream is warped. The two companies both provide multitenant, subscription-based SaaS services, but they are in different spaces with different and even overlapping partner ecosystems and customers.

Both companies have both been around for about ten years. Everdream competes against Altiris (part of Symantec), LanDesk and Microsoft, providing desktop management services from the cloud. The company has 160 employees and about 350 customers. The acquisition by Dell was small enough that financial terms were not disclosed.

In fact, salesforce.com is a distributor of Everdream services and a customer according to its marketing literature:

The company manages more than 160,000 desktop and laptop PCs for companies in 60+ countries around the globe, including ADP, Brocade Communications, Mail Boxes Etc., Inc., Midas International, Salesforce.com, Sonic Automotive and Sylvan Learning Centers.

In addition, Everdream has hooked up with salesforce.com for an on demand employee service desk solution, which combines its own Asset Management software service with Salesforce.com's on demand Service & Support help desk ticket management software service.

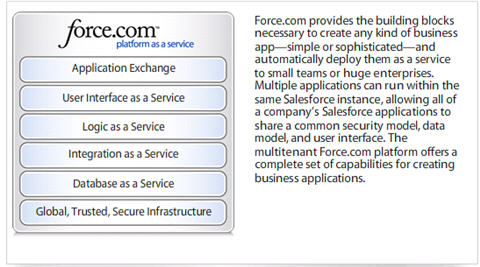

Salesforce.com competes against Oracle, SAP, Microsoft, RightNow, SugarCRM, NetSuite and dozens of other companies with SaaS applications. But salesforce.com has taken SaaS a step further with what the company calls "platform as a service," allowing developers to build any kind of application with its tools on its infrastructure. The company has over 38,000 customers and more than 2,500 full-time employees and will generate an estimated $740 million for its current fiscal year.

Josh's posits that Everdream is a superior SaaS platform, one that salesforce.com wishes it had. It's not clear that Everdream is a platform. Where are the Everdream APIs that allow developers to create and deliver new kinds of applications and services?

Josh correctly points out that Everdream is in a sweet spot, turning desktop managed services for SMBs on its head with a multitenant SaaS solution, just as salesforce.com did for CRM.

It is the kind of service that would have fit well with salesforce.com business beyond the current partnering. But salesforce.com is focused on building out its platform as a service model, which can encompass desktop management services through its APIs or natively. For Dell, it's a smart move that fits with other recent acquisitions such as ASAP Software and Silverback.

Josh's big point is that Everdream's "platform" is better than salesforce.com's Force.com and AppExchange for third parties to generate revenue.

Everdream third-party technology partners, which the company integrates into its service offerings, include products from Symantec (virus protection), Iron Mountain (backup), Microsoft (update services) and WebEx (remote access). Josh wrote:

As such, Everdream’s model is to effectively leave that level of functionality to the partners, as opposed to trying to cover a large portion of it through their own product development efforts. This makes Everdream is a real platform play for these partners, without complicating their efforts by building product that would eventually encroach on these partners’ efforts.

Everdream couldn't build best of breed products in all categories, and providing a great distribution channel for those partners to reach SMBs as part of an integrated suite of services make sense. As pointed out before, Everdream and salesforce.com even have a joint product offering. On the competitive front, Everdream competes directly with Symantec's Altiris division.

Everdream's notion of a partner ecosystem is quite different from saleforce.com's, which opens up the proprietary software development stack and datacenters to any developer. Whether the platform as a service strategy, beyond CRM, pays off remains to be seen.

Josh characterized the salesforce.com's platform and business model as ego-system and largely about aggrandizing itself with little left on the table for its partners. You could say the same about the early stages of Microsoft, SAP and others who built platforms that third parties have been able to leverage profitably.

So far, salesforce.com's AppExchange has more than 725 applications and 31,000 installs, according to the company. Few of those application developers in salesforce.com's long tail can claim great financial success, and the company can end up competing (or acquiring) with its developer community if it decides a new area is lucrative.

But this is just the beginning of the shift to more utility-like computing services (see Nick Carr's The Big Switch) and software development platforms, such as Force.com.

On the personality front, salesforce.com and its co-founder and CEO Marc Benioff are more in the aggressive mold of Oracle and its founder Larry Ellison. Benioff was schooled by Ellison during his 13 years at Oracle with the idea that running a company is akin to running for political office. If you want to get elected, you make some outlandish assertions and sometimes make promises that can't be kept, but you make sure that people (customers) hear you.

Everdream's President, Chairman and CEO is Mark Hoffman, a co-founder of Sybase and former CEO of Commerce One, is a seasoned tech executive who is not known for his brash, campaigning style. Nor is Michael Dell. Hoffman started Sybase in 1984 with Bob Esptein and that company has lived in Larry Ellison's shadow since that time. Hoffman joined Everdream in 2005.

Benioff is focused on building a brand and isn't shy about taunting competitors as part of the program. When Oracle announced it was acquiring rival Siebel in 2005 Benioff said, "Even dinosaurs mate a few times before they die. It’s the end of software. It’s the end of Siebel."

But, Benioff almost single-handedly brought the entire software industry kicking and screaming into the software-as-a-service age over the last decade. And, it's hard to argue with the numbers. For its third fiscal quarter ending October 31 salesforce.com had revenue of $192.8 million, up 48 percent year over year, with $6.5 million (5 cents a share) in net income. Net paying customers topped 38,100, up 41 percent from the previous years. The company expects to have $1 billion to $1.02 billion in revenue for the next fiscal year.

You can ding the salesforce.com for its sales and marketing spend. In effect, salesforce.com is Web 2.0 company, with modern technology and relatively low cost of revenues, and a Business 1.0 style in terms of the cost of sales.

The company spent $96,216,000 on sales and marketing in the most recent quarter, up more than 30 percent from the same quarter last year. In the first nine months of 2007, salesforce.com spent more than half its revenues on sales and marketing.

The cost to acquire blue chip enterprise customers and build a vibrant developer ecosystem can be high, and salesforce.com is out to build its market fast, before powerful competitors from client/server application world move more aggressively to the SaaS model.

Josh finally concluded that Dell has leapfrogged salesforce.com as the SaaS market leader:

Without hardly trying, and with a whole lot less expense, Dell just leapfrogged the SaaS market leader. SaaS market leadership has always been Salesforce.com’s to lose, this is the best indication to date that its leadership credentials are starting to wear thin.

What does it mean to be an SaaS market leader? SaaS isn't a single, monolithic market. It's emerging as the next model upon which almost all software will be based. Salesforce.com will always be associated with the beginning of the SaaS trend, but as on demand becomes more mainstream the focus will be on leaders in different areas. It's not salesforce.com who should be concerned with the Dell/Everdream combo, but others who offer desktop managed services portfolios. Salesforce.com will have enough to worry about from CRM competitors and emerging SaaS development and infrastructure platforms.

Note: On his disclosure page Josh notes that Everdream, Commerce One and salesforce.com are current or former clients.