LucidEra opens for business intelligence on demand

Dubbing itself the salesforce.com of business intelligence, LucidEra ends its beta period and formally opens for business. I covered most of the basics about LucidEra in this November 2006 post. The company's on demand business intelligence (BI) solution is targeting the SMB market, taking a bottom up approach that will eventually lead into larger enterprises

Like its idol saleforce.com, LucidEra can be sold via the telephone and doesn't require legions of consultants or IT staff to deploy, according to company CEO Ken Rudin. "We managed to crack the code of bringing BI to companies of these [SMB] sizes," he claimed. "Our ultimate goal is to be to BI what salesforce.com is to CRM and all kinds of transaction applications."

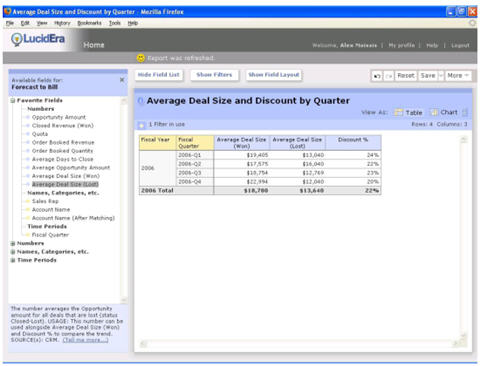

"In most BI implementations somebody else is driving and telling you what you should be looking at," Rudin said. LucidEra puts users in the driver's seat, he said, allowing them to subscribe to the data they need internally. The service supplies components that handle data extraction, data cleansing, OLAP and reporting services, and includes connnectors for common data sources, such as Excel, Oracle, salesforce.com, NetSuite and even Intuit. The first LucidEra application is Forecast-to-Billing, and future applications include a 360-degree view of customers and marketing analysis, Rudin said.

Unlike BI solutions from Business Objects, Cognos, Hyperion (soon to be Oracle) and vendors, LucidEra doesn't offer a highly customizable blank slate. “Instead of answering esoteric questions just a few people have, we focus the vast majority who just want the basic stuff,” Rudin told me last year during the beta phase. “Most people want similar questions answered in a broad range of industries. Our solution should match the needs of 80 percent of the mid-market, and businesses have to be willing to believe that we will be able to answer their key questions, essentially out of the box.”

Target customer and cost are also a differentiators. The company has been working with a dozen beta customers, ranging from 500 to 40 employees. Pricing begins at $3,000 per customer per month, and includes the Forecast-to-Billing service, 100 user seats and pre-built connectors to three data sources.

Rudin identified his chief competition as Excel, especially among smaller companies, and the on-premises solutions from the incumbent BI players and the open source upstarts, JasperSoft and Pentaho. The LucidEra pricing was derived from what it would cost to have someone dedicated to creating analytical reports in Business Objects' Crystal Reports, which Rudin pegged at around $50,000 per year. The more enterprise focused BI solutions cost a significant multiple of $50,000 and take several months to build and deploy, but offer much more flexibility, functionality and often more reliability. LucidEra is targeting 99.9 percent uptime.

"You can build anything you want with Cognos or others, but you have to spend 10 months to build it and can't try before you buy," Rudin said. "And you may end up not get the answers you want."

Like salesforce.com, NetSuite and other software-as-as-service vendors shaking up their respective fields, LucidEra could have a disruptive effect on the BI incumbents, who so far have not made on demand services a priority.

At this point, LucidEra is not even a blip on the screen, but the company is entering the market at a time when on demand software is no longer a fringe movement. By the end of the year, Rudin said the company will open up its platform to developers and system integrators, and create a marketplace for pre-built BI services, similar to salesforce.com's AppExchange.

Rudin views the acquisition of Hyperion by Oracle as kind of blessing as his company enters the market. "It will put pressure on other BI vendors that do a lot of business with Oracle, who will now be pushing its own solution. Companies like IBM and SAP will have to consider additional acquisitions," Rudin said. He also hopes that the acquisition will slow down Oracle, which already has several BI solutions to rationalize as it moves to its future Fusion platform. "Oracle will be spending time on integration, and not on innovation. This gives new companies an opening," Rudin said.