Microhoo: Looking beyond the search war

In the event that Microsoft ends up with Yahoo, which I view as likely, what happens to the Yahoo brand and properties. The back end, infrastructure and engineering issues can be sorted out, although nothing will be easy. Pooling engineering talent, data centers, search, ad systems, etc. can be a big win in terms of cost savings and software development prowess. But how to you sort out the brands? I'll save that question for a bit later.

Microsoft's yearning for Yahoo has some amount of desperation, but there is a pragmatic side to the union. Microsoft's strategy is to get some lift, or at least cause Google some pain, and become a healthy number two in search. It's a marathon, not a sprint, and Microsoft is really good at marathons.

While the company the Gates and Ballmer built is trying to perform the search and advertising intervention, it will move aggressively into the next major battlefield--trying to create the personalized Web portal that is equivalent to Microsoft Office of the last decade, in terms of dominating the market. This is where Yahoo's assets come into play.

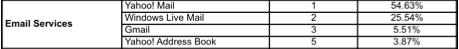

Looking at the data, for the week ending Jan. 26th, 2008, Hitwise pegged the U.S. market share of all Internet visits for Yahoo properties at 13.2 percent. Suitor Microsoft's MSN was 2.3 percent and rival Google came in at 7.7 percent. Google's strengths are search, YouTube, image search, Maps and Gmail, which trails Yahoo Mail and Microsoft's Hotmail.

The Web is becoming more social and personal, and widgetized. Outside of search, or coincident with it, becoming the home page for billions of people, aggregating feeds, email, social connections, photos, video and other content and services, is the end game.

Yahoo is the leader on that front. Time spent, not just number of users or pages consumed, is a key metric. While search is clearly the big dog today, managing the user's preferences, feeds, social graph, messaging and media is a huge opportunity, and Microsoft is trying to assemble the pieces with spare parts from Yahoo and its investment in Facebook, although the $240 million it put into the social network yields about 1.5 percent of influence based on the $15 billion valuation.

Google search doesn't drive massive downstream traffic to other Google properties, but the monetization of search is superior to email, personal pages or other types of applications. In addition, Google has done well in exposing and monetizing its services via APIs. Yahoo and Microsoft have strong email and start pages that drive downstream traffic, according to Hitwise, but famously fall way short of Google in search.

Microhoo could force Google to focus more on iGoogle, trying to be more of a destination for users beyond search or Gmail.

My friend Steve Gillmor characterized Microsoft's strategy as trying to do the same thing to Google in search that Google did to Microsoft Office with Google Apps. The comparison kind of works--at this point Google Apps is a blip on Microsoft's radar, but that could change faster than Ballmer would like. Microsoft search is a blip on Google's radar, although not likely to cause pain any time soon. Steve went on to say, "The goal is not to be number two--it's an ancillary benefit--but to cause enough pain for Google to give Microsoft the time and credibility to take a more open approach to providing a clone of Gmail and other the Google Apps."

While discussing Microhoo on the The Gang podcast taping today, Doc Searls called upon Microsoft to embrace more openness as Google, as well as Yahoo, has done. "Microsoft is still very much about intellectual property and controlling the experience and running things through Windows," Doc said.

Acquiring Yahoo may be a way for Microsoft to break with its more proprietary past, at least in the online division. Most of Yahoo's code is based on non-Microsoft technologies. Rewriting everything salvagable from Yahoo for .Net to avoid BSD Unix or Java would be an exercise in futility.

The question of how Microsoft sorts out the brands is complicated. Perhaps over the long run Yahoo could become Yahoo Live, replacing some portions of MSN/Windows Live and the online division is carved out as a separate company. But the default from day one would be to maintain the two brands, just like they are two cites with a bridge connecting them, but not shoving one or the other down the collective gullets of users.

They would compete with each other in areas such as Autos, where each has success and revenue, but it would also be a chance to choose the stronger services and run them across both portals. Flickr could become the photo sharing site for MSN/Windows Live. Yahoo Answers could be applied to Microsoft's properties, and Yahoo users might be served with Windows Office Live Office (services for small business).

There are some wildcards. Startups such as Netvibes and Pageflakes are pursuing the personal home page, portal approach. Outside the U.S., major players like Baidu in China will try to become the home base for billions of users. Facebook, which has a connection to Microsoft and thus possibly Yahoo, will turn into a more comprehensive portal beyond its social networking roots. But in terms of reaching a broad, mass market with a variety of integrated services, the Microhoo (if the deal is consummated) and Google are the two giants to watch.

If all the players embrace openness and data portability, all roads will lead to wherever users want to go, which is a good way to engender brand loyalty. For users who want to move around, which will be a big minority, give them a way to travel in comfort.