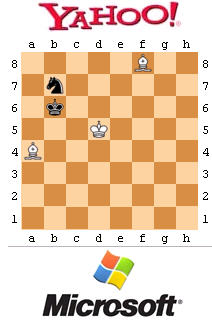

Microhoo: The end game

It's no longer about whether Microsoft and Yahoo could be a loving and profitable union once they get over their hostilities. At this point it's just about the money. But then, it's always been about money.

Yahoo has a few pieces left on the board, but the experts, or at least pundits, view Microsoft's position as stronger. The forthcoming rejection of Microsoft's bid by Yahoo is merely part of the end game.

Microsoft thinks it needs Yahoo to accelerate its "Live" reinvention, and Yahoo hasn't inspired confidence that it can compete effectively with Google, despite its half a billion users. In its most recent quarter, Yahoo reported a 23 percent drop in profit and an 8 percent increase in revenue compared to the Q4 2006.

Competing with Google on search and ads in a titanic marathon is part of the deal logic, but there is also the pragmatic goal of winning the hearts, minds and wallets of billions of consumers with communications services and applications. Integration will be very difficult, but having a common enemy and goals can be a galvanizing force, if inspirational leadership is leading the charge.

Yahoo postures or signals that it wants $40 per share to Microsoft's

And, Google, which cried out that Microhoo could monopolize the Internet, coming to Yahoo's rescue doesn't look promising.

Perhaps this week, with layoffs expected to be announced, Jerry Yang will give a Barak Obama-like State of Yahoo speech that outlines how the company will thrive on its own, sending the stock soaring and staunching a brain drain.

On the quarterly call, Yang said that Yahoo would cut 7 percent of the workforce and heavy investments in "growing strong performing properties." He also said company was not merely “tinkering around the edges.” The news didn't inspire great confidence, but in this turbulent market it's hard for any company to catch a break.

The Microhoo dance is like Oracle's pursuit of BEA. Oracle offered $17 per share, BEA rejected the offer and then came back with $21 per share, and Oracle acquired BEA for $19.375 per share.

There are some nuances in the stock prices and the total cost of ownership. Microsoft bids, Yahoo stock rises, Microsoft goes down. Yahoo counters high, Yahoo stock likely goes down, Microsoft stock does who knows what. The big winners are the bankers, and if Yahoo accepts a deal (closer to $31 than $40), it's shareholders and a good portion of employees waiting for a stock pop will feel satisfied...and will look for new jobs. Note: Based on Microsoft's share price on Friday, the offer is $29 per share.

It's decision time for Jerry Yang and Yahoo's board. Steve Ballmer is waiting with open arms.

See Techmeme for the Microhoo coverage swarm