Finance

Mobile transactions ready to ramp, says report

The value of global transactions on the go will jump from $162 billion in 2010 to nearly a $1 trillion by 2014, according to research firm Yankee Group.

Consumers are increasingly becoming more comfortable with mobile banking, payment and shopping to the point where the value of global transactions on the go will jump from $162 billion in 2010 to nearly a $1 trillion by 2014, according to research firm Yankee Group.

The Yankee Group highlights a few interesting nuggets in its report about what consumers think about mobile transactions.

- For starters, only 10 percent of consumers would pay extra for mobile transaction services.

- Europe Middle East and Africa represents 42 percent of active mobile banking users followed by Asia Pacific at 38 percent. Yankee Group projects that Asia Pacific will have 54 percent of the active mobile banking base by 2014. North America lags at 16 percent and will continue to lag.

- Near field communications (NFC) phones will hit the 151 million mark by 2014, up from 834,000 in 2010. NFC technology allows you to tap your smartphone at a checkout counter to make a payment.

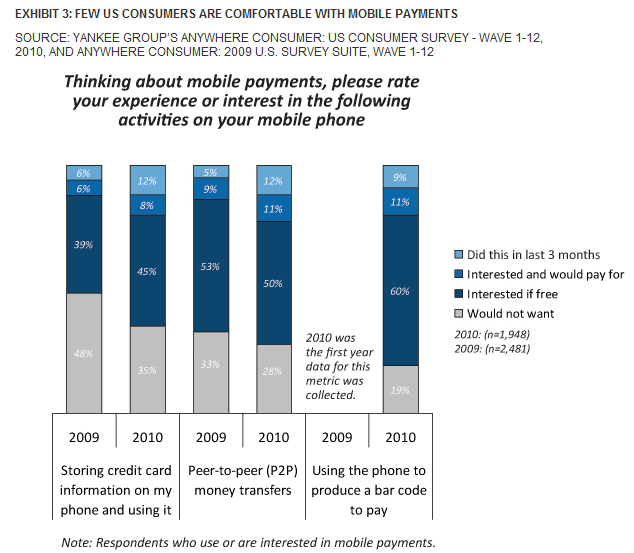

- On the mobile payment front, U.S. consumers are highly skeptical. The chart tells the tale:

- And finally, only 24 percent of U.S. consumers would want to pay for goods by adding a purchase to their wireless bill.