More Americans warming up to mobile banking (survey)

As more options for managing healthcare on mobile devices emerge, it appears that more Americans are also starting to warm up to conducting financial matters via their smartphones and tablets as well.

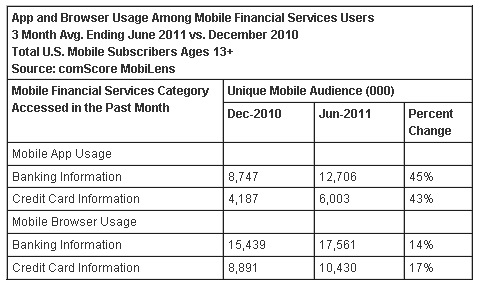

Approximately 12.7 million U.S. mobile users used their personal devices for checking up on banking information by the end of June 2011 -- a 45 percent increase from more than 8.7 million during Q4 2010, according to a new survey from comScore.

Overall, 32.5 million Americans accessed mobile banking information on via tablets and smartphones during the second quarter, which represents 13.9 percent of all mobile users.

Although one likely explanation for this growth could be more confidence in mobile device security among consumers, comScore vice president for marketing solutions Sarah Lenart remarked in a prepared statement that financial services institutions are recognizing mobile trends with more investments for new apps and mobile-enhanced sites.

Her comments also hint at potential opportunities in mobile payments:

While mobile channels have not reached the same penetration that traditional online channels have for the use of financial services, it is interesting to note that mobile users access their credit card accounts on a more frequent basis.

Digitally-savvy customers have begun to use mobile and other connected devices such as tablets to engage in online activities that once used to be limited to the computer and are doing so more frequently because of the portability and convenience offered by these devices. As users continue to incorporate the use of these devices into their everyday lives, financial services institutions can expect to see a more engaged audience grow from their mobile channels.

For instance, nearly 18.4 million Americans used mobile devices to simply access credit card information (up 23 percent in December), and roughly 6 million mobile users used a specific credit card app during Q2 2011, a 43 percent increase.

It's a bit of a stretch, but there is a certain stronger confidence and trust -- not to mention reliance -- on mobile devices (especially smartphones) when it comes to manage finances (and purchases, in regards to credit cards), then that lends weight to the possibility that consumers will warm up to mobile payments just as quickly.

Related: