Now playing at Pandora: Net losses, rapid growth, IPO plans

Pandora has filed for an initial public offering and the streaming music service shows rapidly accelerating advertising revenue, but losses remain on the playlist.

For the nine months ended Oct. 31, Pandora reported a net loss of $7.13 million on revenue of $90.1 million. For the fiscal year ending Jan. 31, 2010, Pandora reported a net loss of $24.8 million on revenue of $55.2 million. That's a big jump from $19.3 million in revenue from fiscal 2009.

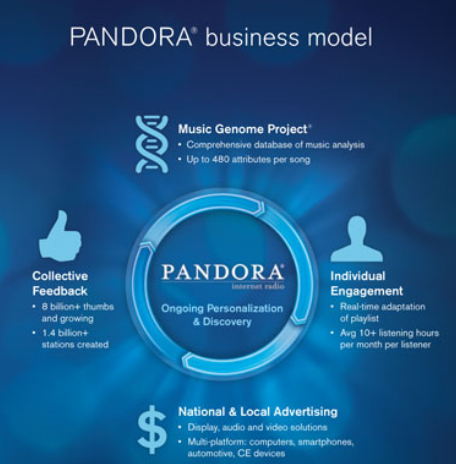

In other words, Pandora has a nice growth spurt underway and advertising revenue far exceeds subscription services. Here are a few key facts about Pandora from its regulatory filings.

- Pandora has 80 million registered users in the U.S. and 800,000 songs in its collection.

- The company is partnered with more than 200 consumer electronics makers.

- Pandora's mobile app has been downloaded more than 50 million times.

- According to Pandora, the game plan is to offer targeted advertising on a local and national level via age, gender and zip code. However, Pandora is dependent on Google's DoubleClick for monitoring.

- Pandora's auditor found material weakness in its financial reporting. The company is fixing the problems.

- The list of competitors is long. Pandora cited CBS and Clear Channel, Sirius XM, Slacker, Rhapsody and Spotify as competition as well as YouTube and iTunes.

- Pandora's risk factors---advertising competition, distribution and music licensing terms---were standard fare. The most notable risk was the following:

Most of our agreements with makers of mobile operating systems and devices through which our service may be accessed, including Apple, RIM and Google, are short term or can be cancelled at any time with little or no prior notice or penalty. The loss of these agreements, or the renegotiation of these agreements on less favorable economic or other terms, could limit the reach of our service and its attractiveness to advertisers, which, in turn, could adversely affect our business, financial condition and results of operations. Some of these mobile device makers, including Apple, are now, or may in the future become, competitors of ours, and could stop allowing or supporting access to our service through their products for competitive reasons. Furthermore, because devices providing access to our service are not manufactured and sold by us, we cannot guarantee that these companies will ensure that their devices perform reliably, and any faulty connection between these devices and our service may result in consumer dissatisfaction toward us, which could damage our brand.