Oracle posts strong first quarter: Hurd makes debut; Exadata the focus

Updated: Oracle handily topped expectations for both first quarter earnings and revenue as the company said its hardware business "grew faster than expected."

The company reported first quarter earnings of $1.4 billion, or 27 cents a share, on revenue of $7.5 billion, up 48 percent from a year ago. Non-GAAP earnings were 42 cents a share. Wall Street was looking for earnings of 37 cents a share on revenue of $7.3 billion.

According to Oracle, both the software and hardware businesses performed better than expected. Both co-presidents, Safra Catz and Mark Hurd, were quoted in a statement. Catz said:

"Our software business grew strongly in all regions with new license sales up 25%. Our hardware business also grew faster than we expected with Sun Solaris servers and Exadata leading the way."

Hurd, who just joined the company, previewed Oracle OpenWorld:

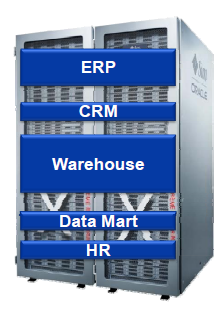

"Next week at Oracle OpenWorld we will announce two new high-end systems that combine Sun hardware with Oracle software."

Hurd also touted Oracle's R&D spending for the year. At HP, Hurd was knocked for scrimping on R&D.

Related: Oracle's earnings on tap as Hurd, Open World take center stage

CEO Larry Ellison said the Exadata pipeline tops $1.5 billion, up from $1 billion a quarter ago. The pipeline, however, doesn't reflect actual sales.

The conference call covered a wide range of topics ranging from services and whether you need them to the IBM relationship and the merger of hardware and software.

Key points from the Oracle conference call:

- Hurd makes his debut and says Oracle is defining the integrated system market. "I think there's a large underappreciated opportunity in verticals," he said. These areas---healthcare, telecom and financial---can no longer afford to do their own software development. Hurd talked up Oracle's sales team and rounded up a few customer wins and touted database and middleware sales. Listening to Hurd riff on Oracle's quarter almost made you forget that he was only at the company for a few days.

- Ellison was also bullish on the hardware business, but did say that "there is really no such thing as the hardware business or the software business. It's really one business." He later noted that the Exadata is a joint hardware and software sale. Oracle moves hardware, but also sells licenses. He cited one win where Exadata machines replaced Teradata systems at Softbank.

- Analysts asked Ellison whether Oracle needed to buy a services unit. Ellison said that if Oracle does a good job on products and making them easier to install the need for services will go away. "You won't need as many integration services," he said. However, Ellison did say that services won't go away. "We have to be prepared to partner with other services related companies," he said. Ellison also noted that IBM was a great services partner, especially in banking. "Our partnership with these services companies is absolutely critical." Hurd added that labor is the biggest issue is services and dealing with problems. Automation is critical because it reduces labor.

- Catz said that Oracle "has a lot of company specific momentum" in a wide range of markets. She argued that Oracle customers are seeing the benefits of an integrated stack. Deals seem to be getting bigger, she said. "Customers are buying our applications and deploying them on our middleware and operating systems both Solaris and Linux," she said.

- Catz added that comparisons for Sun's revenue and prior results are meaningless. "We've ended numerous reselling agreements for Sun," said Catz.

By the numbers:

- New software license revenue was up 25 percent from a year ago to $1.28 billion.

- Updates and support revenue was $3.45 billion, up 11 percent from a year ago.

- Hardware systems revenue was $1.7 billion, or 8 percent of revenue.

- Services revenue was $1.06 billion, up 18 percent from a year ago.

- Revenue in the Americas was $3.9 billion followed by $2.38 billion in Europe, Middle East and Africa and $1.2 billion in Asia Pacific.

- Database and middleware revenue was $3.25 billion, up 17 percent from a year ago.

- Applications revenue was $1.48 billion, up 8 percent from a year ago.

Related:

- HP’s interim CEO: Board likes CEO candidates; We’ll make up with Oracle

- HP: Mark Hurd is violating our trade secrets as part of Oracle

- Can Oracle, Hurd topple HP, IBM without services?

- Questions for Oracle

- Oracle’s Hurd for Phillips swap: What’s the customer relations impact?

- Hurd joins Oracle, Phillips resigns

- Mark Hurd to Oracle? Don’t be surprised

- Oracle Open World 2010: confusion or clarity?