Recession worries? Not for cloud computing

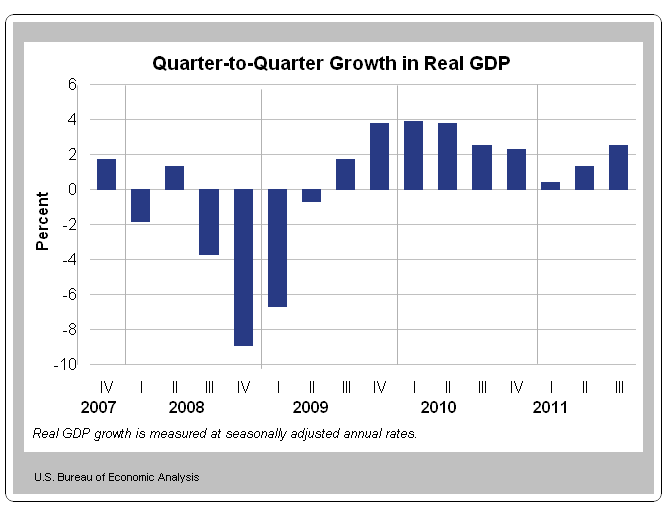

A rocky economic picture is likely to speed up the migration to cloud computing---again.

In the 2008-2009 downturn, companies moved to software as a service vendors en masse. Chief financial officers liked the ability to shift capital spending (build your own data centers and applications) to monthly expenses (subscribing to your software) and gave technology executives a shove to the cloud.

Large software vendors have gotten the message. Oracle CEO Larry Ellison has talked up cloud computing for his company and then bought RightNow. Ellison sees where the IT waves are about to break and is working to hedge his bets.

The evidence that cloud computing may just be recession proof is beginning to stack up. Rackspace, NetSuite and SuccessFactors are all showing no signs of slowing down. Rest assured that Salesforce.com CEO Marc Benioff will preach his cloud migration sermon when his company reports earnings Nov. 17.

Pierre Nanterme, CEO of Accenture, the company that focuses on large IT deployments, said at the end of September that "we continue to extend our cloud capabilities, and are seeing increased demand for software-as-a-service."

"We're doing one of the largest global software-as-a-service implementations, involving work in 70 countries and almost 20,000 users," said Nanterme.

Related: NetSuite: The new SAP as ERP goes cloud? | Oracle acquires RightNow for $1.5 billion, aims turrets at Salesforce.com | RightNow buy opens Oracle's SaaS gambit | Enterprise IT and megavendors: Cloud players angle in on bad marriages | Enterprise IT: Here comes that deer in the headlights look again | Can the cloud bail enterprises out of IT debt?

Here's a tour of what cloud connected companies are saying. These anecdotes and data points indicate there will be a large enterprise rush to the cloud.

Rackspace CEO Lanham Napier said on the company's third quarter earnings conference call:

During the quarter, demand from enterprise customers was strong, both from a new customer acquisition and install base growth standpoint. During the early years of Rackspace, our services were adopted and validated, mainly by small- and medium-sized businesses. And those companies remain a vibrant part of our Company. At the same time, more and more large corporations today are discovering that using a specialized service provider like Rackspace is the better, faster, cheaper way to address their IT needs. And we are optimistic that enterprises will represent a larger share of our revenue going forward.

With 9 months of the year behind us, we are not seeing any significant slowdown in demand for our services.

Now Rackspace as currently constructed is more hosting company than one focused on cloud computing. However, the two businesses are blending together as large companies need both. Rackspace's third quarter cloud revenue was $51 million, up 89 percent from a year ago, but still represents less than a fifth of the company's total sales.

That enterprise spending showed up in Rackspace's results. The company added 8,884 customers in the quarter, but that was less than JMP Securities' estimate calling for 10,000. However, Rackspace's average selling price was higher than expected at $6,560 compared to JMP Securities' estimate of $6,500. Patrick Walravens, an analyst at JMP Securities, noted "higher ASP illustrates how Rackspace is gaining traction with larger enterprise accounts."

Napier noted that Rackspace is growing in a rough economy because the migration to the cloud outweighs tight budgets. If you look at install base growth this year, it has stayed real consistent. It is not at that prerecession level of 1.5%, but it is pretty strong at 0.9%. It is almost double this year versus what it was last year. The question becomes, what is causing this? Why has it stabilized, given all of the macroeconomics choppiness out there? A couple things are driving it. The number one thing driving it is our enterprise business," he said.

NetSuite also managed to show strong third quarter billings. Why? NetSuite is moving up market from mid-sized companies to large enterprises. As those large enterprises move to NetSuite, the company will garner a great stream of recurring revenue.

Zach Nelson, NetSuite CEO, has been on a large enterprise tour of sorts. He was working the crowd at the Gartner Symposium in Orlando. "As you see the market begin to tilt towards the cloud as I've seen it happen over the last year with all of these very large companies really establishing a strategy now," said Nelson.

SuccessFactors CEO Lars Dalgaard agreed that enterprises are going to ramp their cloud spending. Dalgaard also noted that SuccessFactors' focus---business execution software---is also countercyclical to the economy. Dalgaard said:

We see the current economic environment as an opportunity for us to help companies navigate uncertain times. So in that context, we have a countercyclical offering it seems, which enables customers to better understand the importance of linking their performance management strategy with their business strategy to ensure effectiveness at all levels of the company.

On the cloud movement, Dalgaard said:

Obviously Oracle's acquisition of RightNow is a huge validation of what's going on in this market and we've known that from day one. And it's been 10 years that we've been in the cloud, but it is clear that legacy vendors have not been able to do it themselves and we have a unique opportunity to take this leadership and go very deep in these accounts everywhere we go in the world.