RIM: We "don't fret" new competition; reports solid Q1, outlook

updated: Research in Motion reported better than expected first quarter earnings Thursday, but revenue fell just short of expectations. Meanwhile, the company delivered a solid outlook for the next three months.

The BlackBerry maker reported first quarter earnings of $643 million, or $1.12 a share, up from $518.3 million, or 90 cents a share a year ago (statement, preview). Adjusted for various expenses, RIM reported earnings of 98 cents a share. Wall Street was expecting 94 cents a share.

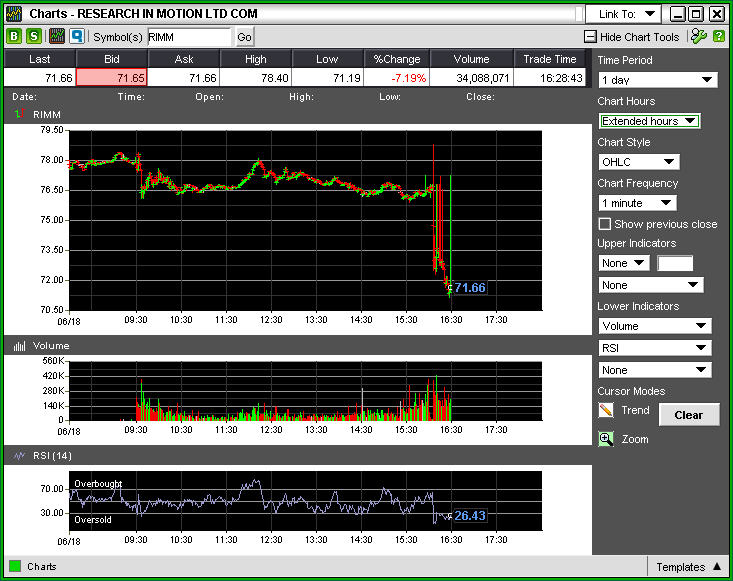

RIM said its sales for the quarter were $3.42 billion, up 53 percent from a year ago, but shy of the $3.5 billion expected by Wall Street. Meanwhile, units and subscriptions were slightly disappointed. Simply put, investors expected too much and sold shares after hours.

Why the reaction? Here's a look at expectations going into the earnings report:

And what RIM actually reported.

- The company shipped 7.8 million devices. That was in line with estimates, but a few analysts expected more.

- RIM reported 3.8 million net new BlackBerry subscriber accounts for a total of 28.5 million.

- The company claimed 55 percent market share in smartphones and Jim Balsillie, Co-CEO at RIM, said he expects to expand BlackBerry's move into new markets.

- Revenue for the second quarter is expected to be $3.45 billion to $3.7 billion with gross margins of roughly 43 percent to 44 percent. Earnings are expected 94 cents a share to $1.03 a share. Wall Street is currently expecting RIM to report second quarter earnings of 99 cents a share on revenue of $3.67 billion.

updated: On a call with analysts today, the company fielded questions about the competitive forces in smartphones, notably Apple's $99 price point on an iPhone and the arrival of the Palm Pre. In his reply, Balsillie said "we don't fret" over what others are doing. It's too early for the Pre to say what sort of impact it might have, he said. In addition, the $99 iPhone is a limited time price to reduce inventory of an older model, he said, and RIM has been aggressive in pricing and promotions for current products - such as the Buy One, Get One Free promo for the Blackberry Storm.

He also spoke briefly about applications and new tools that developers have at their disposal to develop apps, specifically the ability to "push" content through apps, similar to how the original Blackberry pushed email to the device. During the quarter, there were close to 15 million downloads of social networking apps, the most popular of which were MySpace and Facebook. Both offered updated apps during the quarter.

Finally, the company projected new subscriber additions of 3.8 million to 4.1 million in the second quarter, up from the first quarter. The company noted that the quarter is seasonally slow but that new products, including the new Tour, are expected to help drive growth. It expects to ship 8.1 million to 8.7 million units, up from this 7.8 million in the first quarter.