Salesforce.com's monster quarter: Cloud renaissance for enterprise?

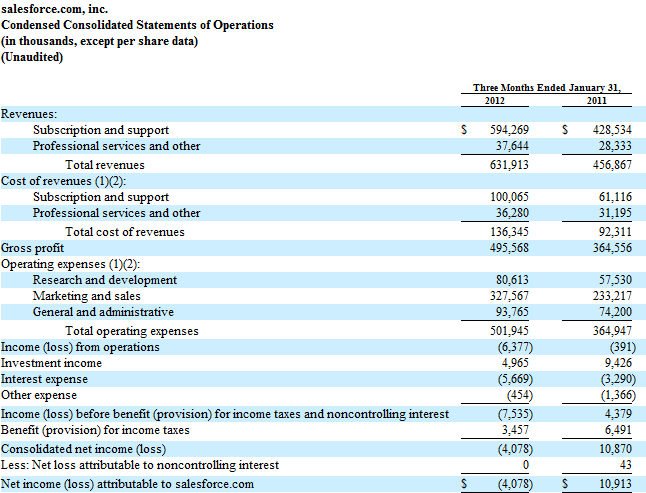

Salesforce.com broke out some big numbers with its fourth quarter results---a nine-figure deal, deferred revenue topping $1 billion, 100 seven-figure transactions with nine hitting eight figures---and those numbers may add up to a historical inflection point for the business software industry.

Marc Benioff, CEO of Salesforce, was his usual enthusiastic self on the company's earnings conference call. "We now see a growing number of companies standardizing their entire front office on Salesforce.com," said Benioff, who noted HP is using Sales Cloud, Service Cloud, Chatter and Force.com. HP represented Salesforce.com's largest deal in the fourth quarter.

Benioff certainly believes the time is now for cloud companies. He said:

This is the Renaissance. We are in the great time. This is the time to create all this amazing new technology. We've all changed the devices we use, we are all changing how we use computers.

Needless to say the company's ability to land big deals have analysts generally gushing. JMP Securities analyst Patrick Walravens said:

With over $1 billion in billings in the quarter, we think it is fair to suggest that this quarter marks a point of historical significance for the software industry. While the software as a service trend has been growing rapidly since 2005, it is now exploding as major enterprises are accelerating their adoption of cloud computing.

In addition, Salesforce is making it a bit easier for enterprises to buy. Stifel Nicolaus analyst Tom Roderick noted that Salesforce is bundling Sales Cloud, Service Cloud, Radian6 and Chatter into broader enterprise license agreements. In other words, Salesforce is landing annualized payment terms from many customers.

Sound familiar? Those payment terms are what SAP and Oracle get.

Salesforce.com does appear to be moving up the strategic standings versus its much larger rivals. The company comes in with its social enterprise mantra and walks customers through the process. Not surprisingly, other Salesforce.com products get wrapped up into big deals.

Benioff said:

This social enterprise strategy is about coming into companies and our message is: we want to listen to you, and we want to understand what -- where you're trying to go strategically. The world is moving to social, as the world is moving to mobile, as the world is moving to cloud, our customers are saying, how do they build their employee social network, their customer social network, and their product social networks? And we are becoming a trusted advisor. And through our thousands of salespeople all over the world, we want to have that trusted, interactive relationship with them where we can sit down. And in that process, the deals are getting bigger.

Not everyone was on the renaissance bandwagon. Peter Goldmacher, an analyst at Cowen & Co., said that Salesforce.com changed its invoicing policies and that overstated growth.

At first blush, the company beat 4Q expectations and 1Q and FY13 guidance is low. It was a strong quarter with 100 seven figure deals, nine eight figure deals and the huge nine figure deal pushed into 1Q. However, billings growth of 57% was artificially inflated by $80M in incremental deferreds from a change in invoicing duration and a $75M spike in long-term deferreds from large deals. Normalizing for these two factors yields 35% billings growth, roughly in line with expectations. These two deferred revenue dynamics could persist all year. Looking at deferreds on an apples to apples comparison, we believe that sales force productivity likely declined again this quarter.

In any case, Salesforce.com is increasingly pushing the enterprise software giants. In the process Salesforce.com is becoming one of those giants too.