SAP buys its way into the cloud party: Will it work?

SAP hopes to become the largest cloud computing player in 2015 and it has a plan to get there: Acquire its way to the top.

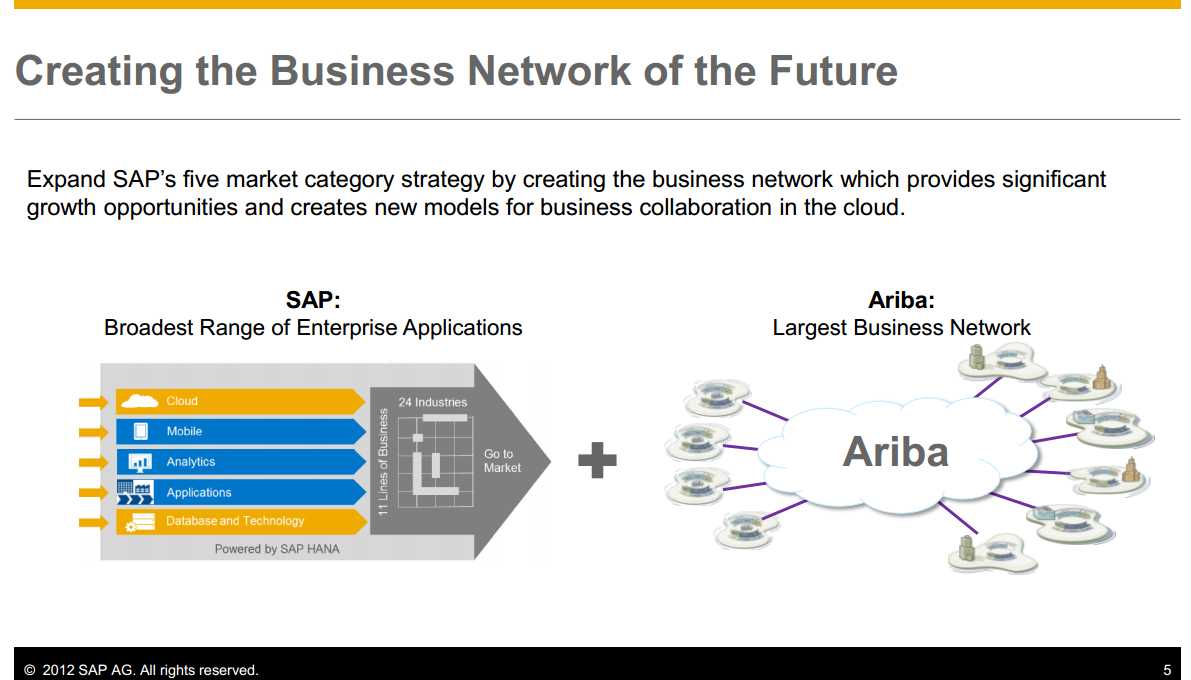

The enterprise software giant pulled the trigger on the acquisition of Ariba for about $4.3 billion. The move comes just a few days after its Sapphire conference in Orlando where SAP outlined its cloud efforts. Meanwhile, SAP recently just closed the purchase of SuccessFactors.

In other words, SAP is only a few more deals away from putting together some real cloud revenue. SAP executives predicted that the merger will produce about €2 billion ($2.6 billion at current exchange rates) in cloud revenue by 2015. Toss in SuccessFactors and SAP's own cloud offerings and the company has a shot at being larger than Salesforce.com, which Wall Street estimates to bring in nearly $5 billion in revenue for the year ending Jan. 30, 2015.

SAP's grand cloud acquisition rhymes with what Oracle did in on-premise software. Oracle acquired multiple enterprise software players. Oracle is trying to do the same with cloud computing, but seems a bit out of step. SAP buys SuccessFactors and Oracle acquires Taleo. Oracle also bought RightNow.

Bottom line: SAP is willing to pay up to be a cloud player and land some big deals.

The larger question here is whether this rollup approach in the cloud will work. It's quite possible that SAP and Oracle can acquire software as a services players and only enable smaller, more focused players to emerge.

For its part, Salesforce.com is likely to tout its heritage as a pure cloud company and one that's focused. Salesforce has made a bevy of acquisitions, but they are smaller technology based deals. IBM also buys up smaller cloud computing players and tucks them in. Workday will probably have a similar spiel to Salesforce's pure focused cloud line. The only thing that matters though will be what IT buyers will think. The cloud lacks the lock-in of on-premise software so defections can occur quickly.

To wit: SAP's cloud chief Lars Dalgaard boasted in a memo how SuccessFactors dumped Salesforce.com, Concur, RightNow, Netsuite, OpenAir, Coupa, Avalara and Onbase for SAP's on demand software. That ability to swap infrastructure cuts both ways.

Here's the rub: Cloud customers of Ariba, SuccessFactors, SAP and Oracle can make similar switches in mere weeks. SAP executives seem to know the cloud game is a bit different. SAP co-CEO Bill McDermott assured that the Ariba merger would "maintain the openness of the business network" while also connecting to competitors such as Microsoft, NetSuite and Oracle. To its credit, SAP plans on operating SuccessFactors and Ariba as mostly independent units.

On the surface, rolling up cloud players for SAP and Oracle makes perfect sense. But without maintenance and software lock-in, keeping customers may be a bit trickier.