SAP: Revenue growth strong, margins projected up

SAP on Tuesday reported second quarter net income that was down 9 percent from a year ago due primarily to merger integration costs, but revenue surged 18 percent. The company said it will hit the high end of its 2008 revenue targets.

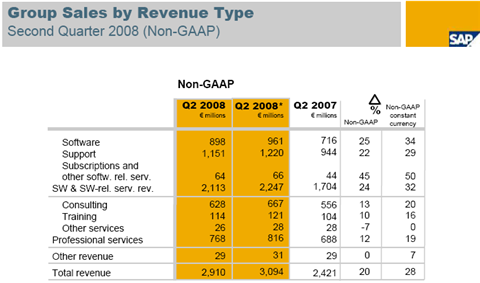

The enterprise application giant reported second quarter net income of 408 million euro, down from 449 million euro a year ago. Total revenue was 2.86 billion euro, up 18 percent from 2.4 billion a year ago. Software revenue was up 25 percent to 898 million euro and software and software related service revenue was 2.06 billion euro, up 21 percent from a year ago. The results were ahead of analysts projections.

Operating margins in the quarter were 20.7 percent, down from 24 percent a year ago, but other than that SAP reported a strong quarter and doesn't appear to be hit by any enterprise spending worries. SAP said its second quarter margins were hit by a 25 million euro expense to settle litigation and one-time costs to integrate the Business Objects acquisition. SAP also is pushing through maintenance and support price increases (much to the chagrin of users) that will bolster margins in the future.

As for the outlook, SAP said software and software related service revenue will hit the high end of its projected growth range of 24 percent to 27 percent. SAP's organic growth will be at the high end of its 12 percent to 14 percent range. Non-GAAP operating margins, which exclude Business Objects charges, will be in the range of 28.5 percent to 29 percent.

Also see: SAP aims to make upgrades easier; Rolls out enhancement packages; Touts analytics

Traditional software licensing: Why you pay more and a look at your options

The SAP results come amid an ongoing court battle with Oracle over TomorrowNow, which provides support for its rival. Oracle in an amended complaint argued that SAP CEO Henning Kagermann and the executive board knew that TomorrowNow was poaching Oracle's intellectual property. SAP said Oracle is reiterating its previous complaint and will argue its side in court, which may make it to trial in 2010. SAP is shutting down TomorrowNow.Outside the court Oracle and SAP continue to duke it out even though you could argue they are a duopoly that is about to benefit from price increases.

By the numbers:

- SAP said its market share was 33.7 percent for the last rolling four quarters, up 7.7 percent from the same rolling period in 2007. Of that growth rate, 4.5 percent came from organic growth with 3.2 percent courtesy of Business Objects.

- Software revenue in the Americas was 306 million euro, up from 259 million euro a year ago. Europe Middle East and Africa had revenue of 444 million euro in the second quarter, up from 350 million euro a year ago. Asia Pacific and Japan came in at 148 million euro, up from 107 million euro a year ago.

- Software and software related service revenue in the U.S. was 472 million euro in the second quarter, up 415 million euro a year ago.