Selling HP's ongoing reinvention

On his way to becoming the next Lou Gerstner, the no-nonsense, conductor of IBM's turnaround in the 1990s, HP CEO Mark Hurd was busy setting Wall Street expectations. And unlike his predecessors--Carly Fiorina and Lew Platt--there would be no overpromising and underdelivering.

Hurd was extremely prepared and on message at the securities analyst meeting in New York, which Larry and I covered this morning. If you are judging HP on their execution this shindig was very well executed--almost too much so. The way Hurd handles the numbers and has turned the company around; Wall Street has to love him...even with the cloud of the pretexting scandal hanging over his head.

Several HP executives gave presentations, which were carefully orchestrated to continuously repeat and reinforce the themes Hurd laid out at the beginning of the event. The main message is that since Hurd took over as CEO about two years ago, HP has gone from "surviving to thriving." Hurd said that the pools of revenue are clear and that HP will take care its cost issues and process opportunities. It's all about execution on the strategy, he added, and layered on the theme that HP is a company that is transforming, but is not transformed. "Don't get too over-excited about 2006 [performance]," Hurd told the financial analysts. Another iteration of Hurd's reduce expectations theme, echoed by other presenters: "HP still has a lot of work to do."

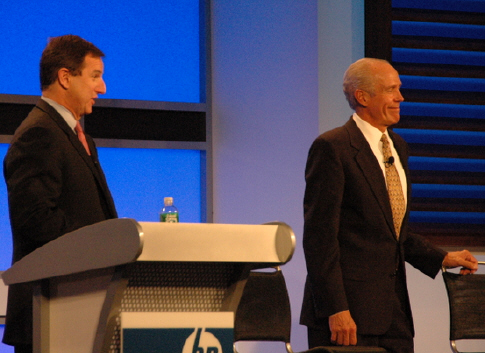

HP CEO Mark Hurd and soon to be ex-CFO Bob Wayman

Every presenter talked about operational efficiency. "There's significant opportunity to improve. We've spent our time trying to understand what the highest scale company in industry should look like in 2009. We're not there yet," Hurd said.

Sales execution, Hurd said, is a key area of focus for growth among all customer segments. Ann Livermore, executive vice president of HP's Technology Solutions Group, said her division, which targets the global 2000, is focusing on sales improvement, getting denser coverage of sales people across the customer base and applying serious discipline interconnecting sales, planning and analytics. Sales and employee compensation will be tied back to margin performance, Livermore said.

Part of HP's growth strategy is to attach services to every product in the portfolio, she said, increasing HP's share of wallet. "We have a strategy and portfolio advantage because we can blade everything," Livermore said, noting that blades sales can effectively lead to attachment of software as well as assessment and design services.

On the personal technology front, Todd Bradley, executive vice president of the Personal Systems Group, said, "As we look at how we drive efficiency in our model, you will see us continue to price very aggressively and continue to drive profitable growth that is so important and to invest in spaces that are critical for growth like client virtualization." Bradley said his group shipped 35 million devices in fiscal 2006.

During a Q&A period Bradley was asked about the impact of Vista: "There is no impact on holiday demand with the delay of Vista," Bradley said. "From a cost perspective, Vista is a bigger memory footprint, and it has made the memory market somewhat tight in the short term. I dont think we expect to see Vista as a growth driver in the enterprise. Consumers will see it as an advantage as the product gets launched. It will be a very smooth transition, create some exciting in the space in the spring, but I don't expect any huge anomalies or supply issues."