Skype, Demand Media indicate tech IPO window open and well

Skype and Demand Media have both filed to go public in recent days and seem to indicate that the tech IPO window is alive and well.

On Monday, Skype filed for an IPO. Skype's offering should be a high profile affair and has already generated a good bit of attention. Meanwhile, Demand Media, a content company, filed its IPO papers on Friday. Toss in the IPOs of NXP Semiconductors, RealD, Qlik Technologies and the high-profile debut of clean tech auto play Tesla and it's been a busy two months for public market debuts.

Of the recent batch of IPO filings, Skype's registration statement is among the most interesting. Skype was sold to an investor group by eBay, which retains a stake. There was a good bit of drama over the rights to the P2P technology the company uses between eBay and Skype's founders.

With that P2P technology hubbub resolved, everyone is going to make some money. Skype counts Wall Street's biggest names---Goldman Sachs, J.P. Morgan and Morgan Stanley---as its underwriters. In addition, nearly every other firm on the Street will play a role on the Skype deal. Here's what you need to know:

- Skype reported net income of $13.1 million on revenue of $406.2 million for the six months ended June 30.

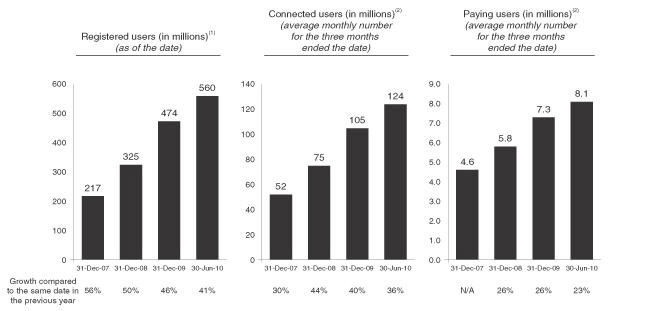

- Skype is growing users at a rapid clip---much of this data was included in eBay's earnings until Skype was unloaded.

- The company said it has 124 million users as of June 30. Skype to Skype minutes were 88.4 billion for the six months ended June 30, up from 49.1 billion for the same period a year ago. Billing minutes for the six months ended June 30 were 6.4 billion, up from 5 billion in 2009.

- Skype's will float American Depository Receipts since it is a foreign company.

- Skype plans to invest $37 million in its infrastructure in 2010, up from $13.5 billion in 2009. Much of that investment is going toward an SAP ERP system. There's also investment in HR systems and office space.

- The company paid $343.8 million to JoltID for the P2P technology that powers its service.

Demand Media also has some powerful Wall Street underwriters including Goldman Sachs and Morgan Stanley. The Demand Media results, however, aren't nearly as mature as Skype's. Demand Media touts proprietary algorithms, a freelancer network and online studio as its key assets.

Here's what you need to know about Demand Media:

- The company reported a net loss $6 million for the six months ended June 30 on revenue of $114 million. For 2009, the company reported a net loss of $21.98 million on revenue of $198.4 million.

- Demand media's owned and operated sites---eHow and Livestrong.com---had more than 86 million unique visitors. Customer Web sites generated 800 million page views.

- Google is the company's biggest risk factor as Demand Media is dependent on search engine optimization. Danny Sullivan at Search Engine Land handicapped the SEO risks. In its SEC filing, the company said:

We have an extensive relationship with Google and a significant portion of our revenue is derived from cost-per-click performance-based advertising provided by Google. For the year ended December 31, 2009 and the six months ended June 30, 2010, we derived approximately 18% and 26%, respectively, of our total revenue from our various advertising arrangements with Google. We use Google for cost-per-click advertising and search results on our owned and operated websites and on our network of customer websites, and receive a portion of the revenue generated by advertisements provided by Google on those websites. Our Google cost-per-click agreement for our developed websites, such as eHow, expires in the second quarter of 2012 and our Google cost-per-click agreement for our undeveloped websites expires in the first quarter of 2011. In addition, we also engage Google's DoubleClick ad-serving platform to deliver advertisements to our developed websites and have another revenue-sharing agreement with respect to revenue generated by our content posted on Google's Youtube.com, both of which are currently on year to year terms that expire in the fourth quarter of 2010. Google, however, has termination rights in these agreements with us, including the right to terminate before the expiration of the terms upon the occurrence of certain events, including if our content violates the rights of third parties and other breaches of contractual provisions, a number of which are broadly defined. There can be no assurance that our agreements with Google will be extended or renewed after their respective expirations or that we will be able to extend or renew our agreements with Google on terms and conditions favorable to us.

Add it up and both Skype and Demand Media will have interesting market debuts. How they fare will go along way to determining whether venture capitalists and Silicon Valley start getting better exits.