Sprint earnings: More progress in fourth quarter, but still dropping subscribers

Sprint Nextel's fourth quarter revealed a company that is making progress, but not enough to give AT&T and Verizon much of a fight. The wireless carrier slowed customer defections, but is still losing subscribers and falling short of Wall Street estimates.

Sprint reported a fourth quarter net loss of $980 million, or 34 cents a share, on revenue of $7.9 billion. The loss includes a charge of $306 million for deferred taxes. Wall Street was expecting a fourth quarter loss of 19 cents a share on revenue of $8.03 billion, according to Thomson Reuters. Factoring out the charge, Sprint lost 23 cents a share, a sum that still fell short of estimates. For the year, Sprint lost 84 cents a share on revenue of $32.3 billion.

The good news?

Sprint lost 69,000 net retail subscribers in the fourth quarter. That's improvement over recent quarters. In the third quarter, Sprint lost 135,000 retail subscribers. The company ended the year with 48.1 million customers, down from 48.3 million in the third quarter.

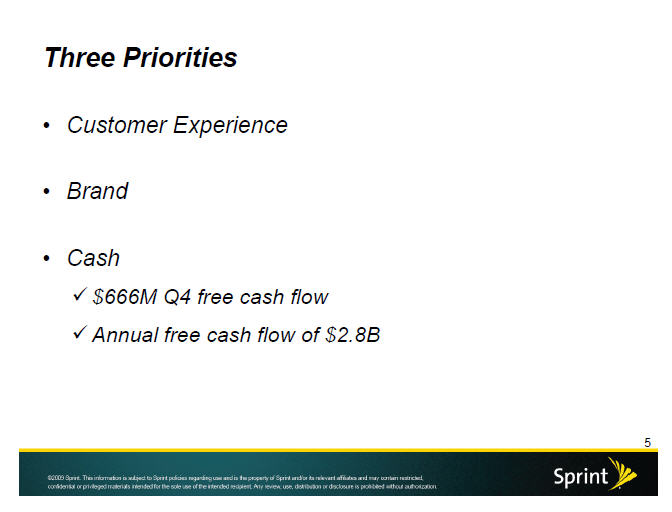

On a conference call with analysts, Sprint CEO Dan Hesse touched on familiar points. Sprint is making progress in cash flow and subscriber losses as it improves customer service. Sprint delivered $666 million of free cash flow in the fourth quarter.

Hesse noted that Sprint "still has to do better on churn." Fourth quarter churn was 2.11 percent, down from 2.16 percent a year ago and 2.17 percent in the third quarter. "I wish we would have made more progress on churn," acknowledged Hesse. "It is our plan to improve churn in 2010."

Meanwhile, Hesse said that Sprint's Boost Mobile prepaid brand is facing increasing competition as rivals offer more competitive pricing. That trend is likely to continue, said Hesse. Overall, Sprint expects more competition for its "simply everything" pricing as Verizon and AT&T get more aggressive on price. Hesse noted that Sprint will still cost consumers less each month.

Hesse talked up Sprint's 4G services including the Overdrive hotspot, which was recently reviewed by Matthew Miller.

Review: Sprint Overdrive rocks 4G at more than double 3G speeds

As for the outlook, Sprint said that subscriber losses will continue to improve in 2010 and the company will continue to generate free cash flow.

By the numbers:

- 9 percent of post-paid customers upgraded their handsets in the fourth quarter.

- Prepaid churn was 5.56 percent, compared to 8.2 percent a year ago.

- Wireless post-paid average revenue per user in the fourth quarter was $55, down $56 a year ago.

- The company spent $427 million on capital expenditures in the fourth quarter, up from $304 million a year ago.

Related: AT&T earnings: E-readers, iPhone, netbooks propel wireless subscriber gains

Verizon earnings: Fourth quarter on target; Loss due to layoff costs; Wireless hums along